AI’s promise for advisors is immense. This is a moment of profound opportunity—not just for efficiency gains, but for using innovation to redefine the advisor-client relationship in ways that build trust, deepen connections, and create sustainable growth.”

Darren Tedesco | Advisor360˚ president

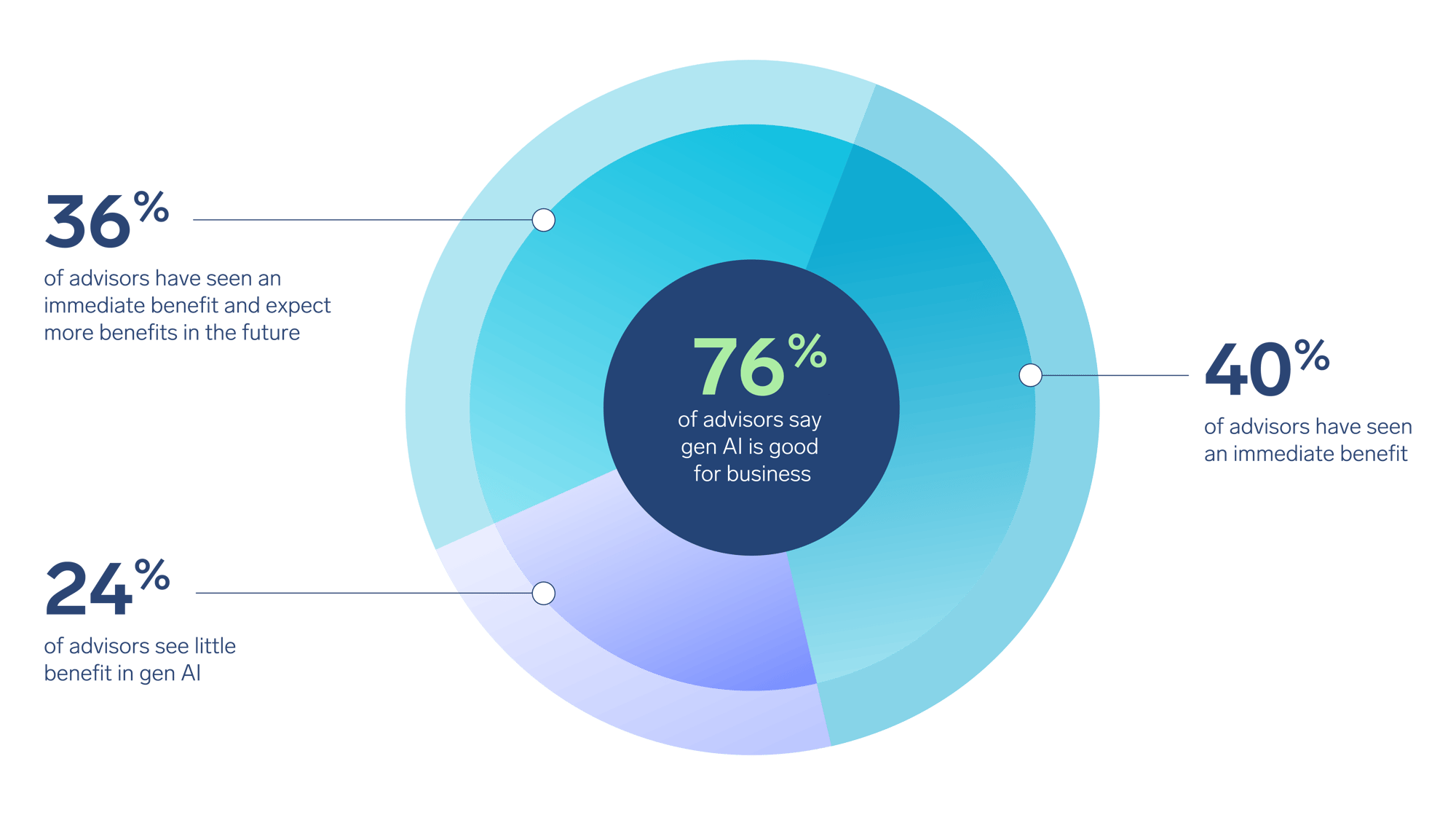

Advisors are all-in for generative artificial intelligence

3 out of 4 advisors say gen AI is already boosting their business

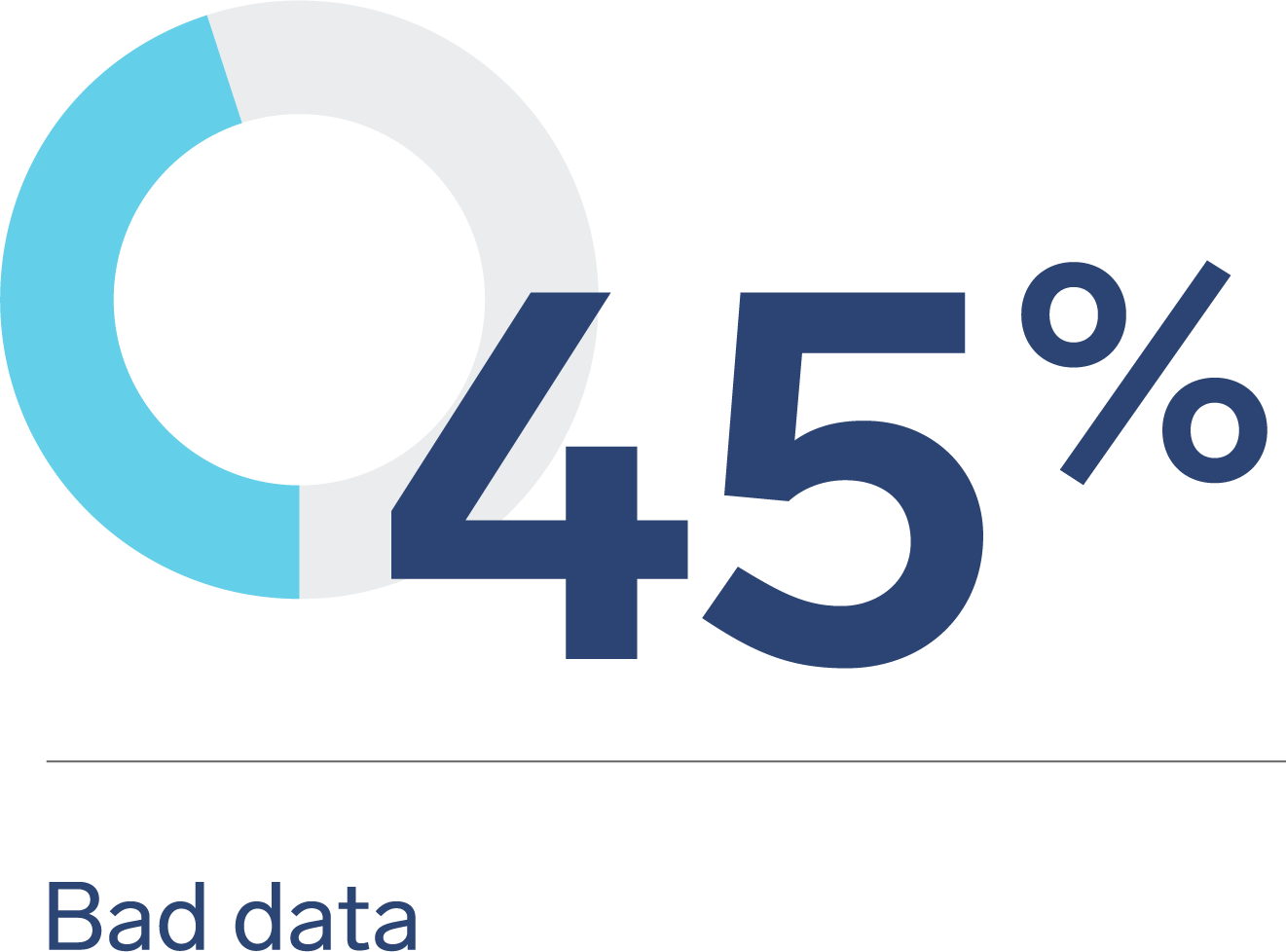

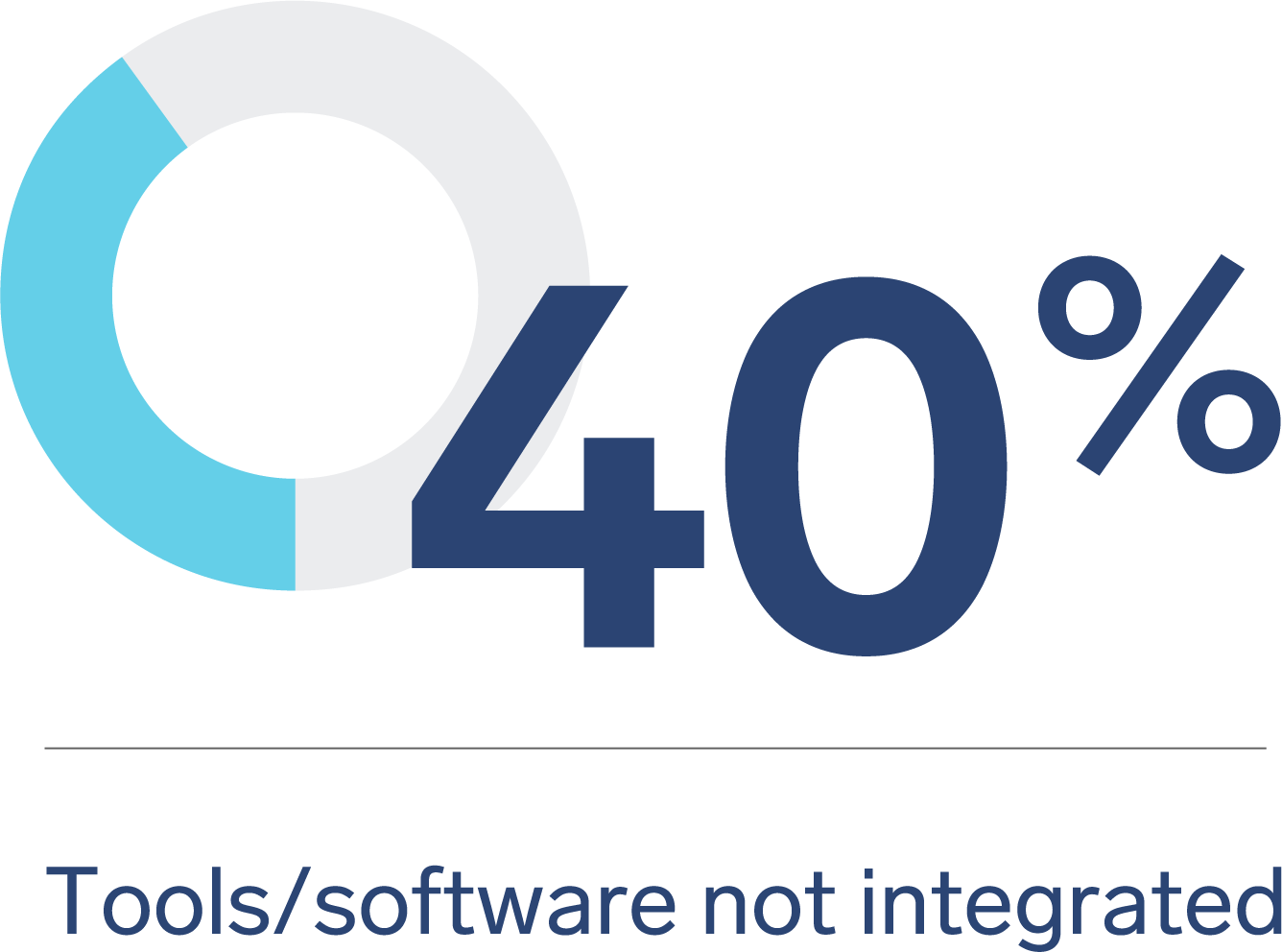

Advisors share their top tech issues

What are the key challenges you face with the technology set-up at your firm?

Drive better business decisions with the 2025 Connected Wealth Report

Advisor preferences and perceptions about technology present an opportunity for growth-minded firms. To recruit top advisors and their clients, wealth management firms need to embrace and invest in technology that:

- Boosts advisor productivity

- Enhances firm growth and efficiency

- Engages current and future clients

About the research

Advisor360° surveyed 300 financial advisors at enterprise wealth management firms in the U.S. to better understand their perspective on how technology impacts the way they conduct business. Responses were collected via a telephone- and email-based survey fielded during September and October 2024. Survey participants self-identified as being responsible for managing – individually or as part of a larger team of advisors – an average of $2 billion in assets and hail from firms with an average AUM of $103 billion.

About Coleman Parkes

Coleman Parkes is a full-service B2B market research agency specializing in IT/technology studies, targeting senior decision-makers in enterprises across multiple sectors globally. For more information: research@coleman-parkes.co.uk