Technology has emerged as a prevailing factor in whether advisors remain at their current firms or leave in search of something better. Firms that invest in digital tools to create an ecosystem that supports advisors and their clients are positioning themselves to lead.”

Darren Tedesco | Advisor360˚ president

Technology is a key reason advisors leave

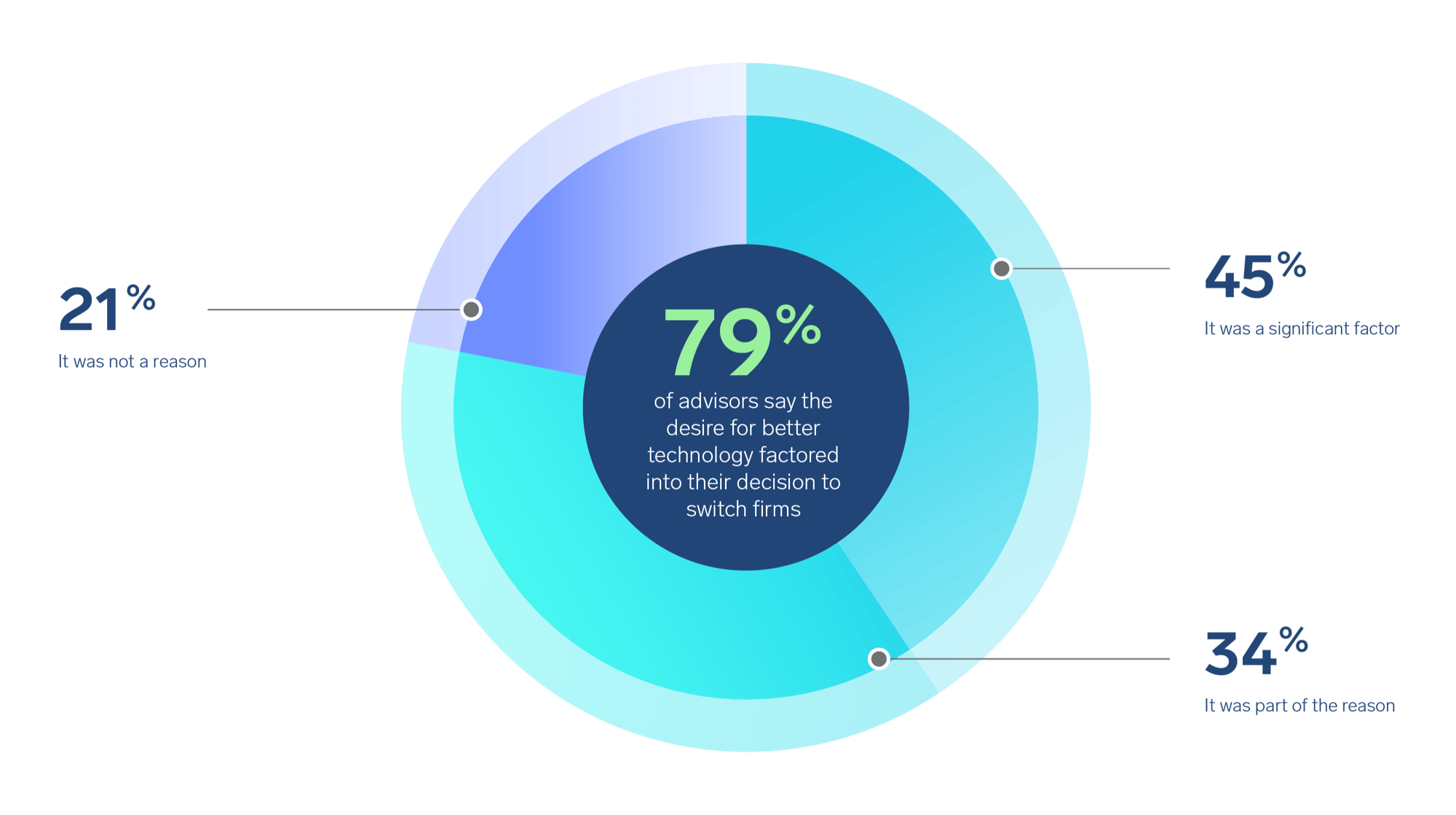

Was the desire for better technology a factor in your decision to switch firms?

Advisors share their top tech issues

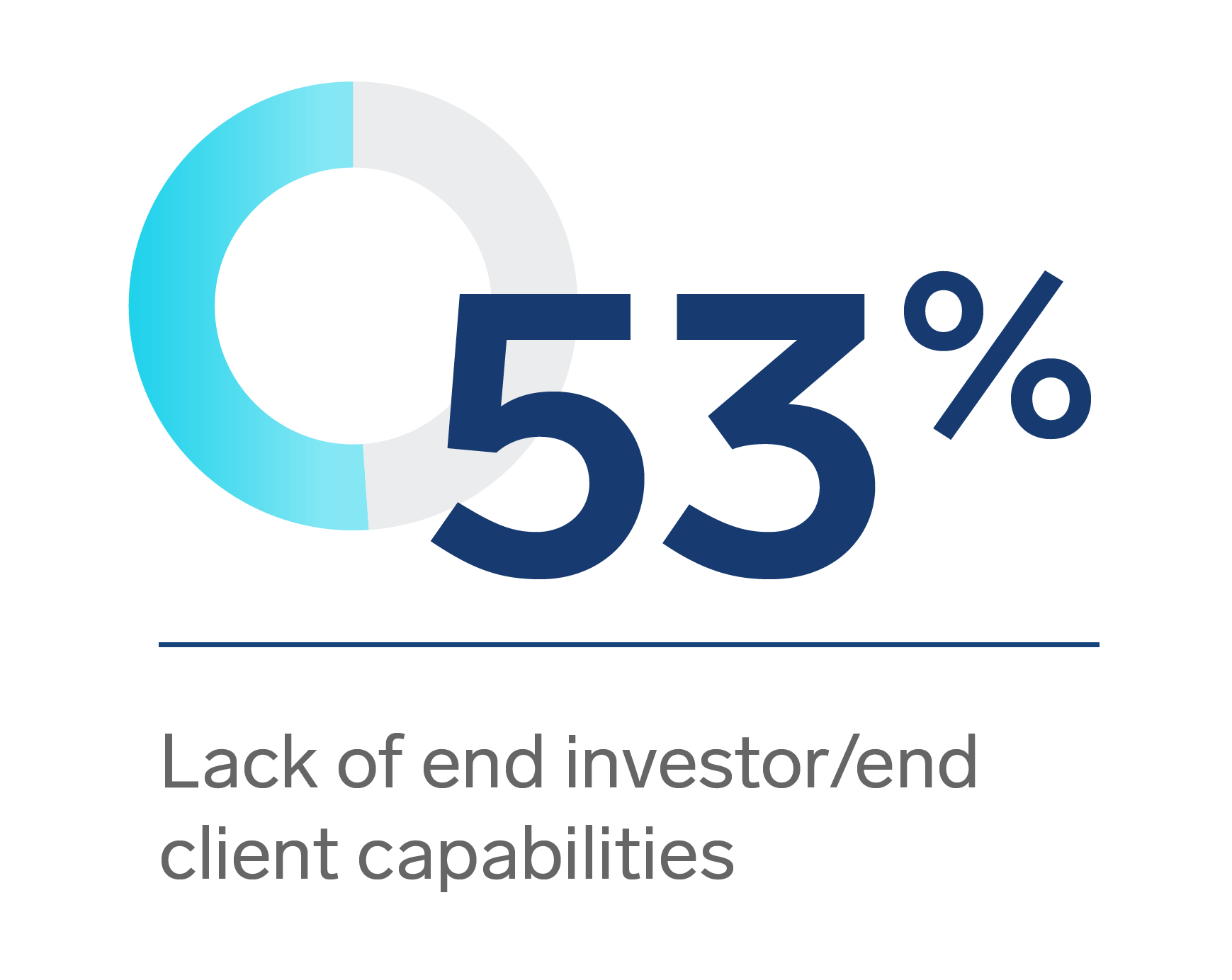

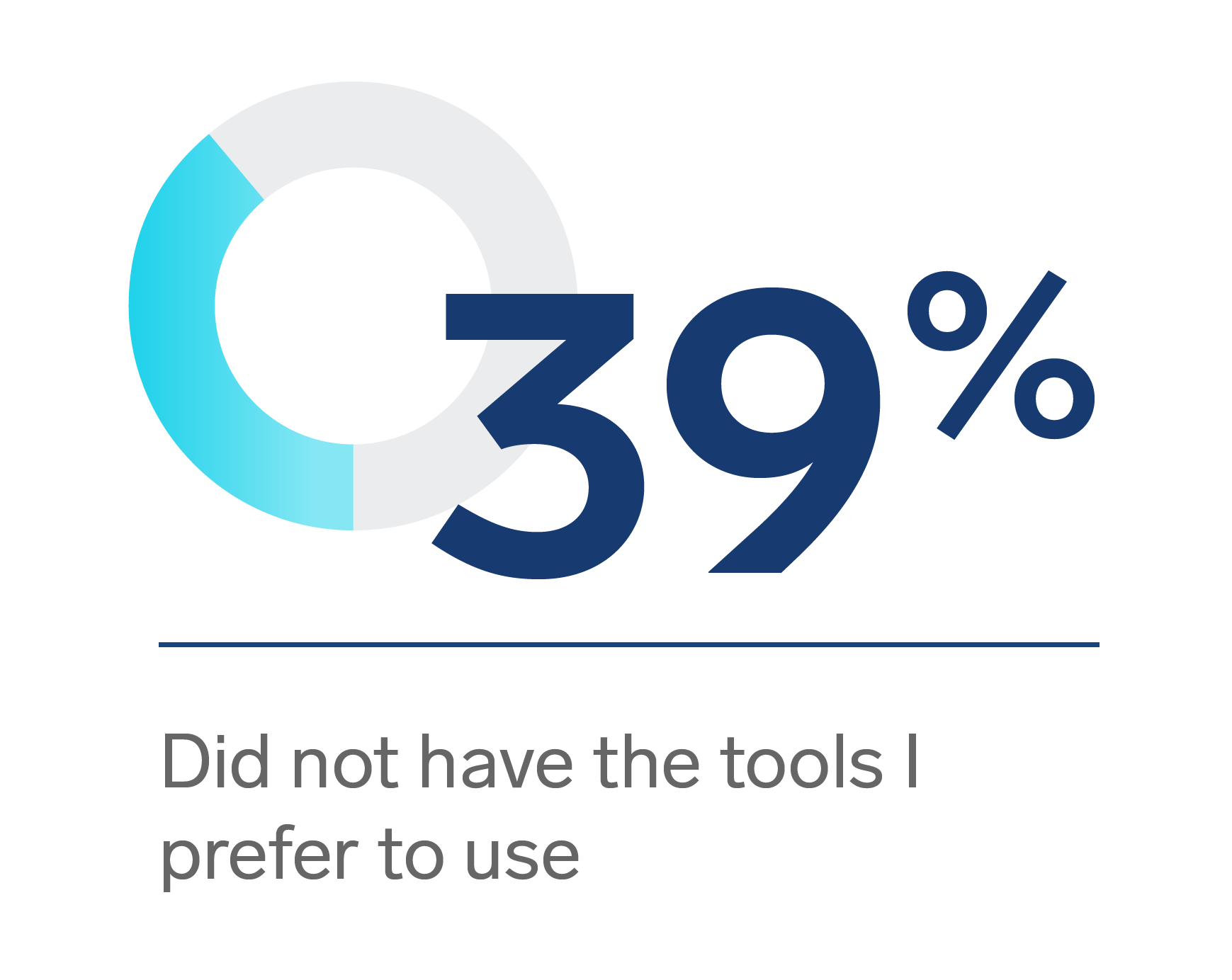

What were the main challenges you faced with technology at your previous firm?

Do more to attract top talent with the 2025 Connected Wealth Report

Advisor preferences and perceptions about technology present an opportunity for firms. The Advisor Transitions Connected Wealth Report offers insights and advice to help firms make strategic decisions that:

- Attract advisors and help them operate more efficiently

- Deliver a high-quality advisor and client experience

- Help advisors grow their business

About the research

Advisor360° surveyed 155 financial advisors at enterprise wealth management firms in the U.S. who switched employers within the last three years to better understand what motivated them to make a move. These responses were collected in connection with a larger telephone- and email-based survey of 300 U.S. financial advisors focused on the impact of technology on the business of wealth management, which was fielded during September and October 2024. Survey participants self-identified as being responsible for managing, on average, $2 billion in assets – individually or as part of a team – and hailed from firms with an average AUM of $97 billion.

About Coleman Parkes

Coleman Parkes is a full-service B2B market research agency specializing in IT/technology studies, targeting senior decision-makers in enterprises across multiple sectors globally. For more information: research@coleman-parkes.co.uk