Unlocking the Habits of High-Performing Advisors

Top advisors aren’t born—they’re built. And their habits are hiding in your data.

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

3 min read

Patrick Noonan

:

9/29/22 12:12 PM

Patrick Noonan

:

9/29/22 12:12 PM

Advice360° is a series designed to help advisors increase their productivity using our digital wealth management software.

In this installment, Patrick Noonan, Advisor360°’s Product Manager for Wealth Management and Insurance, shows financial advisors how our goals, proposals, and document vault capabilities can save them time and enhance their clients’ experiences.

Advisor360º’s new enhancements to our goals, proposals, and document vault capabilities have been designed to accelerate advisors’ ability to meet the needs of clients. These key set of enhancements support our focus on improving how advisors can do their jobs and create happier clients.

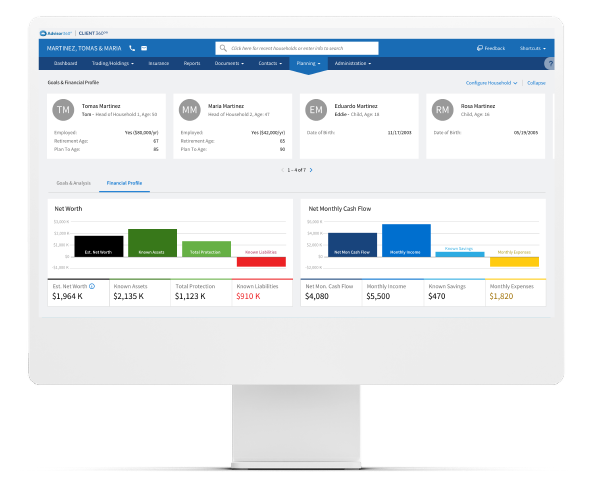

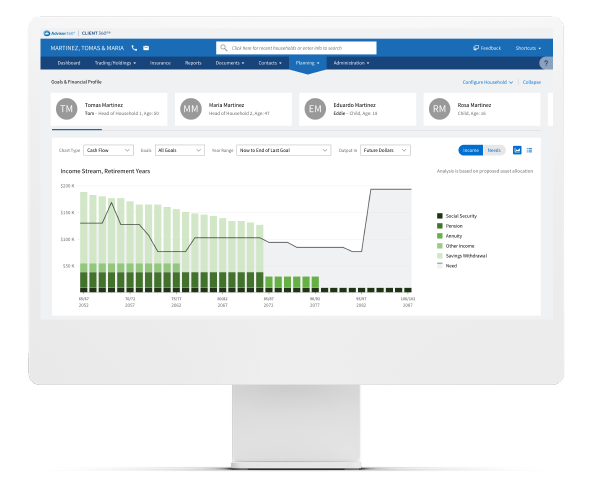

The goals capability allows users to model standard asset allocation templates and integrates with our model management capability to bring in models made by the advisor, their firm, and third-party strategies. This enables the user to model their specific recommendation and illustrates to the client how this recommendation will impact their plan. Here are some of the new services offered:

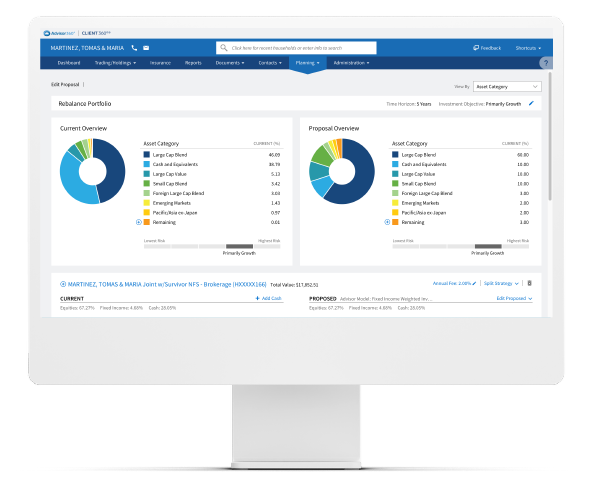

The proposals capability isolates the asset allocation and investment recommendation portion of the client’s financial plan. This allows advisors to look at one or many investment accounts and model different asset allocation strategies with a household allocation rollup. The proposal capability also offers back testing of your current and proposed portfolios. Here are some of the new features:

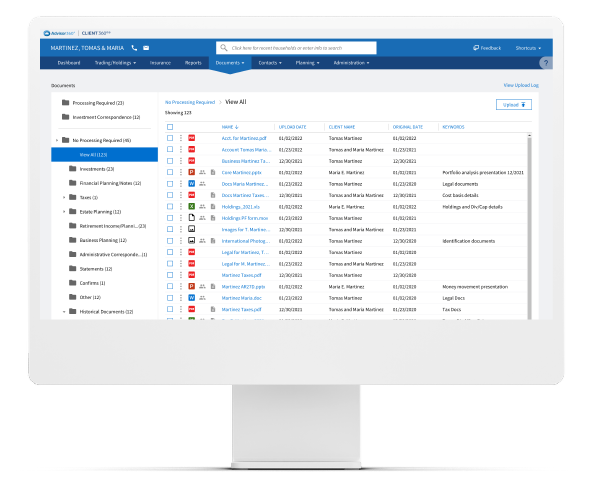

The document vault capability has an updated user experience that provides a more seamless navigation of folder structures and document search. Here are some of the new features:

Our goals, proposals, and document vault capabilities demonstrate Advisor360º’s commitment to market leadership, reinforced through innovation. This release is the latest in a set of product innovations released over the past few months and planned for 2022 and beyond.

Advice360° offers tips and guidance to advisors on increasing their productivity through the Advisor360° wealth management software. Learn what other wealth advisors are doing to benefit their practice.

Patrick Noonan is Product Manager for Wealth Management and Insurance. Backed by his years of experience as a Certified Financial Planner (CFP®), Patrick defines and oversees product features that improve broker-dealer, advisor, and investor performance and efficiencies in the banking, investment, and insurance industries.

Top advisors aren’t born—they’re built. And their habits are hiding in your data.

We live in a world of intelligent technology. The apps we use for travel, shopping, fitness, and healthcare remember preferences, anticipate needs,...

Schwab IMPACT 2025 lived up to its reputation as one of the liveliest gatherings in our industry. You could feel the energy, optimism, and curiosity...