I’m often asked by co-workers or industry pundits “what’s next?” in the world of WealthTech.

My answer is usually tongue-in-cheek along the lines of “let me think about it.” In reality, no one can predict the future, yet the essence of strategy is to try to do exactly that: best understand where things are going, choose what you will do to make peoples’ lives better to solve their problems (which, when you do, people gladly give you money for doing so), and choose what you will NOT do (see Michael Porter’s “What Is Strategy?”).

The essence of our strategy is about understanding the WealthTech trends and then making a choice of what you will and won’t do to address those trends.

The trend is your friend

One of the most powerful forces in this world is momentum; either in a positive or negative way, once you have momentum, it’s very hard to change it. Writing this blog in what I hope is an almost post-COVID-19 world, there is a trend that is undeniable: leveraging technology to collaborate online is here to stay. In the past, most advisors were heavily centered on meeting with their clients in person—then in March of 2020, the whole world changed in a matter of mere weeks. While the pandemic has been horrible and has led to many deaths worldwide, there are some positives that will be taken from this era.

One of these positives is that over the last 3 months, more clients and advisors have met virtually, and the feedback I’ve heard from advisors is that clients have appreciated this new form of meeting and now expect this to be the norm going forward.

Key takeaway: WealthTech companies need to ensure that collaboration tools are a core part of their software offerings.

Artificial intelligence (AI) is just getting started

Ten years ago, I wrote about voice navigation being a big trend that we will start to see in tools and apps. These days, Alexa, Siri, and a whole host of other named virtual assistants are mainstream. Three years ago, I wrote about AI being a big part of our future. In hindsight, I may have understated the importance and impact.

The world has pivoted quickly from technology complementing humans to humans complementing technology.

In 2015, I wrote an article for the Journal of Financial Planning titled “Creating the Blended Advisor Experience” with a focus on exactly this: that technology and the advisor worlds are blending. We’re now seeing that advance rapidly.

“Next best actions” suggested we’ll pivot to actions taken by technology without human intervention.

Many model-management trading systems, including robo-advice companies, have been doing this with auto-rebalancing of portfolios for a while now; moving from investments to operations and planning functions will have an even greater impact.

Key takeaway: AI will take hold in how both broker-dealers and advisors run their businesses and serve their clients and begin taking action without human interaction.

A means to an end

Twenty years ago, the minority of financial advisors were planning-centric in their advice to clients; investments or insurance were almost always the focus. Now in reality, investments and insurance are an important part of helping any given client achieve their goals—but they’re products that are a means to an end. Fast-forward to 2020, the move toward leading with holistic financial planning is here and here to stay.

Understanding all pertinent aspects of a client’s life and helping them plan for successful outcomes of what is most important to them is now driving advisor/client conversations.

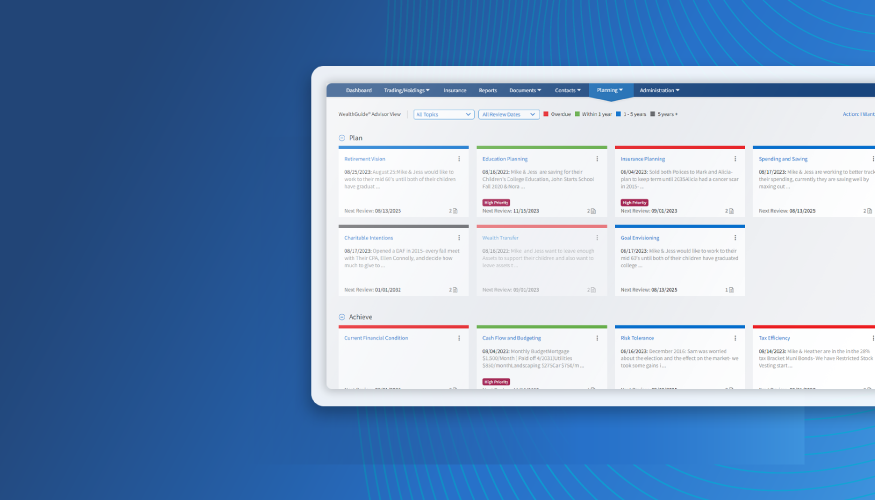

The real challenge for advisors is how to perform holistic financial planning at scale (creating a full-blown plan for a client can take upwards of 10+ hours). Enter WealthTech, and more specifically in our case, WealthGuide®. WealthGuide is an Advisor360° system created eight years ago that allows advisors to customize myriad planning topics and create a “living agenda” that is used at every meeting with a client. This living agenda ensures that pre-existing assumptions and facts are still correct, but also reinforces the value proposition of all the elements that a financial advisor brings to the relationship. Tying this all into a client portal will allow for co-planning between advisors and clients in real-time which is the ultimate panacea.

Key takeaway: Financial planning is more important than it has ever been. Finding ways to scale that process is mission-critical for the financial advisors of the future.

Subscription fever

Did you know there are subscription services/apps that now help you review how many subscription services/apps that you might be paying for—why is that? It’s because the masses have now embraced subscription-based models, yet it’s sometimes hard to keep track of all your subscriptions. I recently reviewed my subscriptions and realized I was paying for almost a dozen of them (TiVo, Hulu, Netflix, HBO GO, Disney+, Amazon Prime Video, SHOWTIME, etc.). The downside is that if you aren’t leveraging all these services regularly, you are wasting money.

There is, however, an upside to the subscription trend when it comes to WealthTech: paying for software should be subscription based, not AUM or account based.

From the end-user’s perspective, I’ve never understood the concept of your technology getting more expensive just because the stock market went up one day, and I never will, which is why Advisor360° charges fees solely on a per user subscription model.

Key takeaway: The world has turned to subscription-based software, including wealth management software.

The future wealth management is WealthTech that looks like…

In the end, your business needs to operate in an efficient and modern way. Partnering with a firm that allows your business to keep up with the macro trends—online collaboration, data and AI, co-planning, and a subscription-based software model—allows you to focus your time on what really matters: engaging with clients.

Are you ahead of the curve?

Darren Tedesco is President of Advisor360°, and has been part of our software development since its inception, bringing together the thinkers, creators, and visionaries that help power our clients’ productivity, profitability, and growth.

Darren Tedesco

Darren Tedesco