In this installation of FinTech Conversations, Patrick Noonan, Product Manager for Wealth Management and Insurance, and Meredith Connell, Sr. Product Manager of Wealth Management at Advisor360°, focus on what it means to be multi-custodial, why it’s so important to firms—for onboarding, advisor recruiting, and much more—and how Advisor360° is addressing this need through platform enhancements.

What does it mean to be “multi-custodial?”

Patrick Noonan: The word “multi-custodian” comes up a lot in the media and things that we're reading about in the financial industry right now. Talk to us about what multi-custodial means and why it's important for firms?

Meredith Connell: The term “multi-custodian” has been getting a lot of attention recently, and I think rightfully so. Firms may describe themselves as multi-custodian if they choose to partner with more than one custodian or if they offer technology capabilities that cater to multiple custodians.

There's a variety of reasons why wealth management firms either consider or are actively partnering with more than one custodian today.

One reason is flexibility. A firm that's open to leveraging more than one custodian may have a leg up when it comes to recruiting advisors or acquiring practices. When an advisor chooses to affiliate with a new RIA or a broker-dealer, they may be forced to transition their whole book of business to a new custodian as part of that move, which can be a very labor-intensive event. So having that flexibility to potentially retain their book of business at the preferred custodian provides a lot of value. It can eliminate some of the stress involved in that move, as well as bring some continuity for clients. Clients don't necessarily need to learn a new client portal or sign new account paperwork to have those accounts established with the new custodian. There's flexibility for advisers joining the firm as well as existing advisors to have more than one option at their fingertips.

Another reason that firms may consider being multi-custodian is either pricing or product availability. When an advisor is thinking about implementing a specific investment plan for a specific client, they may gravitate towards capabilities offered at one custodian versus another. It’s another way to have optionality from client to client.

And lastly, a lot of advisors use third-party technology throughout their day to manage their business. But advisors often must leverage the custodian’s technology as well—at least to some extent—whether it's for account opening, trading, maintenance, or other types of requests. Just as advisors may prefer certain products or capabilities with one custodian versus another, they may also have a preference when it comes to the technology being offered by a particular custodian.

Data, digital onboarding, and beyond

Patrick: That's great and makes a lot of sense. We work with a lot of different custodians like NFS and Pershing and we're always looking to strengthen those relationships. Tell us a little bit about what Advisor360° does to support custodians today.

Meredith: From day one we've had some level of integration with the main custodians in our industry, and it continues to be something we evolve and expand upon over time. I think the key area that Advisor360° supports is the data received from custodians. Today, we integrate and leverage data from all the major custodians including Fidelity, Pershing, and Charles Schwab. We cleanse that data and normalize it as part of our unified data layer, and then that data is available and reflected throughout our platform. It can then be viewed holistically, whether at the practice level or at an individual client or household level. That custodial data is also what powers our suite of reports.

As part of the research for our 2024 Connected Wealth Report we found that over 60% of advisors ranked data as the primary issue they face day to day. Centralized custodial data is an important concept and something that we've always focused on at Advisor360°.

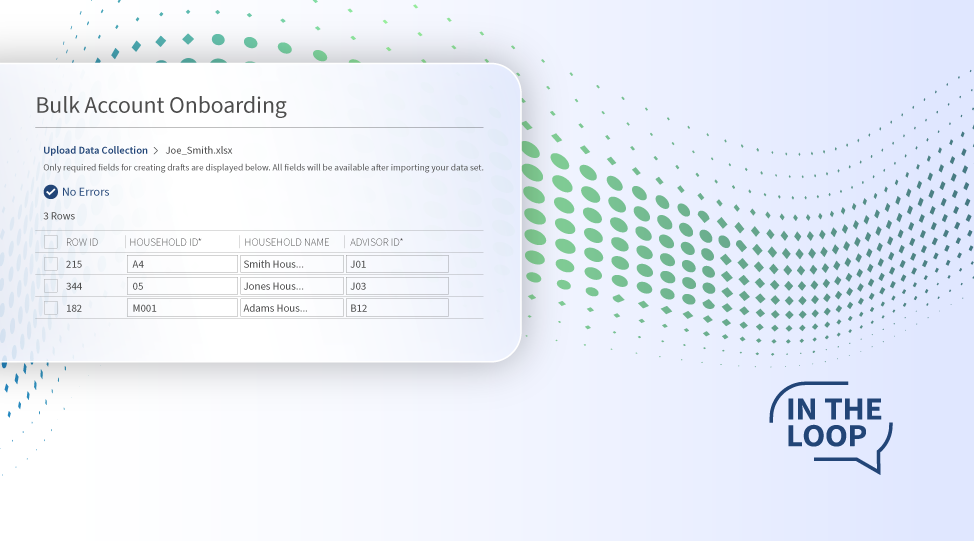

Beyond the data, another area that we focus on is automated account opening with Fidelity, Pershing, and Schwab. Our account opening tools allow advisors to collect new account information for those custodians and produce a single bundle with that data populated onto each custodian's required paperwork that can then be sent to the client in a single signing experience.

Lastly, in addition to data and account opening, we support custodians holistically across the platform with custodial trading, some types of account funding, and the ability to view custodial documents.

Straight-through account opening with multiple custodians

Patrick: What kind of pain points are we looking to solve with our Account Opening capability, and what does that mean for multi-custodial firms?

Meredith: Having a cohesive, unified account opening platform is one of our main focuses. Looking ahead, we have a lot of exciting enhancements coming to our digital onboarding platform, including automated, straight-through account opening with custodians (including Fidelity, Pershing, and Schwab) and other account types. At the end of the day, we're focused on providing a single, streamlined account opening experience for advisors, regardless of who or how many custodians they're choosing to work with. We often hear that the account opening process can be cumbersome and disjointed, especially for those RIA firms that partner with more than one custodian. They're typically forced to follow distinct workflows and use specific technology for each custodian. So, the process for opening an account and onboarding it successfully at Pershing may look different than at Schwab. Our goal is to remove as much of that friction as possible and have a centralized solution that supports all that business, helping to boost productivity for advisors and home offices, and create more efficiencies, especially during the complex process of onboarding new clients.

Patrick Noonan is Product Manager for Wealth Management and Insurance. Backed by his years of experience as a Certified Financial Planner (CFP®), Patrick defines and oversees product features that improve broker-dealer, advisor, and investor performance and efficiencies in the banking, investment, and insurance industries.

Patrick Noonan

Patrick Noonan