3 min read

“How” questions that drive client engagement and communication

Jeff Schwantz

:

3/14/24 3:26 PM

Jeff Schwantz

:

3/14/24 3:26 PM

Have you ever worked with a team or individual that listened intently to a question and gave you a “yes”…but it was only so you’d leave them alone? It happens to all of us. You thought you created engagement and alignment but, alas, you did not. It turns out that “yes” is nothing without the "how.” By asking ourselves and our teams the correct “how” questions, we can build a path forward to better communication with clients. The bottom line: The quality of the answers depends on the quality of the questions.

I’ve written about why tech platforms fall short for enterprise wealth firms, now I want to focus on what works by asking the "how” questions. The 2024 edition of our award-winning Connected Wealth Report sheds light on essential capabilities and applications that drive client engagement. We found that when advisors pair tools that give them a single reliable, trustworthy, timely, accurate, and comprehensive lens into their clients’ complete financial lives, with capabilities to communicate and collaborate according to their clients’ preferences, it provides the foundation they need to effectively serve clients across generations. That’s where the “how” questions can help.

Keeping pace with clients

Consistent communication between advisors and clients helps build trust, yet advisors face new challenges when they are serving multiple generations. Here are some “how” questions to help bridge the gap when working with and serving multiple generations, to drive action and more effective client engagement and communication:

- How does your communication style meet the needs of your client(s)?

- How many generations are in a household and how do they want to communicate?

- How on board are your clients with your communication plan? Is your team on board?

- How do the tools you use serve your clients' needs?

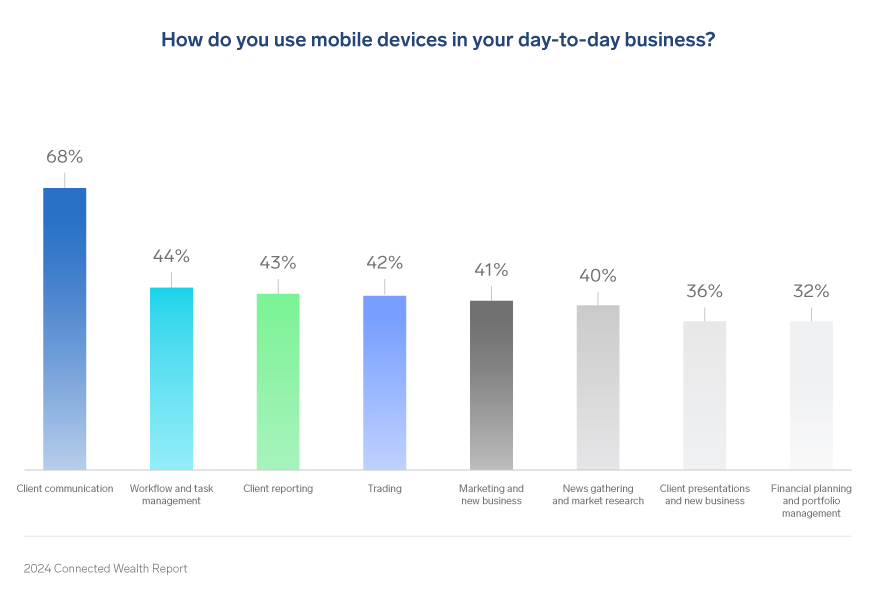

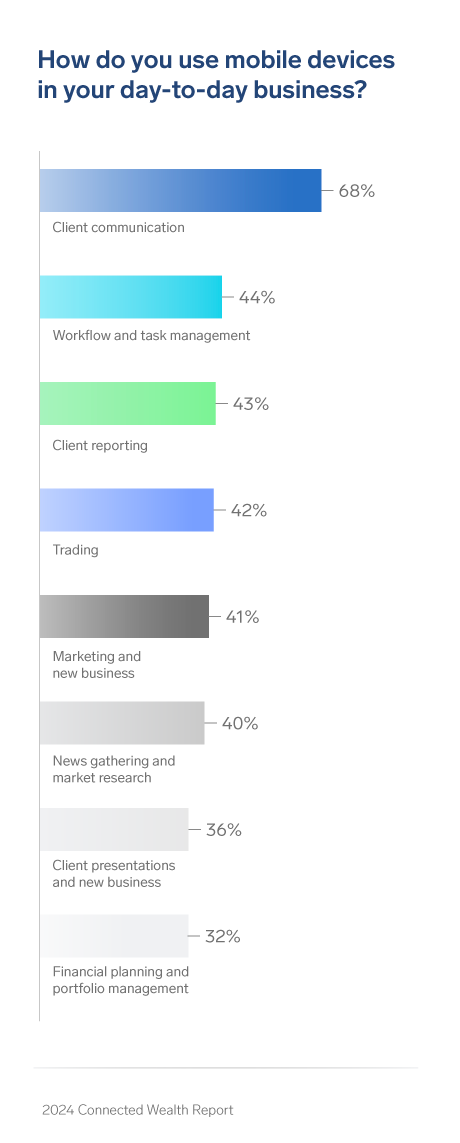

Young professionals are on the move in their lives and careers, and their wealth management needs may shift at a moment’s notice. Luckily, most advisors are attuned to their needs. According to our survey, 68% of advisors rely on mobile devices daily for client communication. They also use cell phones and tablets for other tasks, including client reporting, prospecting, and even trading. Firms need to make sure they provide their advisors with technology to work on-the-go to meet clients where they’re at. They also need to ask the right questions to get to know how and when clients prefer to collaborate and communicate.

Be social, and integrate it into the practices

The rise in the number of ‘finfluencers’ offering advice on everything from mortgages to retirement plans has fueled expectations for financial advice 24/7. Younger investors want an easy way to check-in with their advisor when they have a few minutes in their day. That's where social media comes in. Survey respondents view platforms such as LinkedIn, X/Twitter, and Facebook as essential to a firms’ tech stack, especially when it comes to marketing to current clients and prospecting new ones. Firms that integrate this tech into their platform, keeping SEC marketing guidelines mind, will have an advantage when it comes to retaining and attracting the industry’s top talent.

Questions to guide your social media strategy:

- How are my clients and prospects using social media for education and advice?

- How can I organize my team to engage and inform clients via social channels?

- How does my firm support our social media efforts?

- How can I ensure that my firm is up-to-speed on industry rules pertaining social media content and communications?

The quality of the answers depends on the quality of the questions

Future-proofing your business means listening to your customers and meeting them where they are at. But are you asking them the right questions to understand where they truly are? Over half of the advisors we surveyed said that remote meetings are more popular than in-person interactions for younger clients. Meanwhile, older members of Gen X and baby boomers prefer in-person meetings. Advisors need to have the systems and process to accommodate both.

Besides understanding their logistical preferences for meetings (in person vs. online), ask these additional “how” questions to orient your understanding of where they are at:

- How will we know we are on or off track?

- How will we address the things we find are off track?

- How can we make sure we deliver the right material, to the right people, at the right time?

The frequency of client meetings is also an issue, with younger investors requiring fewer touchpoints. Nearly half of advisors we surveyed report the need for less engagement with younger households compared to their older counterparts. Whether their clients need a high-touch or hands-off approach, advisors have an opportunity to build trust and loyalty by factoring client preferences and age differences into how they communicate. Regardless of frequency, the aforementioned “how” questions can help you remain on track.

The bottom line

Investing in tech solutions that can alleviate bad data, leverage accurate information, and deliver what today’s wealth management clients seek is mission critical. Consistent data is paramount, and leveraging AI capabilities is just one way routine tasks can be offloaded or automated. In the end, it’s about providing clients with an accessible digital experience—one that provides practical solutions and offers a single, holistic lens into their financial lives.

The 2024 Connected Wealth Report explores advisors’ collective perspectives on technology and its impact on the wealth management industry. Amid a shifting landscape, advisors have voiced the need to interact with clients in new ways tailored to meet the emerging generation of wealth holders. Mobile communication, a social media presence, and video conferences are just a few of the tools respondents cite for future growth.

Jeff Schwantz, CRO at Advisor360°, is responsible for leading the Sales and Marketing teams and guiding the company’s revenue generation strategy/execution and go-to-market approach.