Stop Settling, Start Scaling: Tech That Powers RIA Growth

The RIA space is evolving—fast. Competition is fierce. Client expectations are rising. And AI is upending how advice is delivered. In this...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

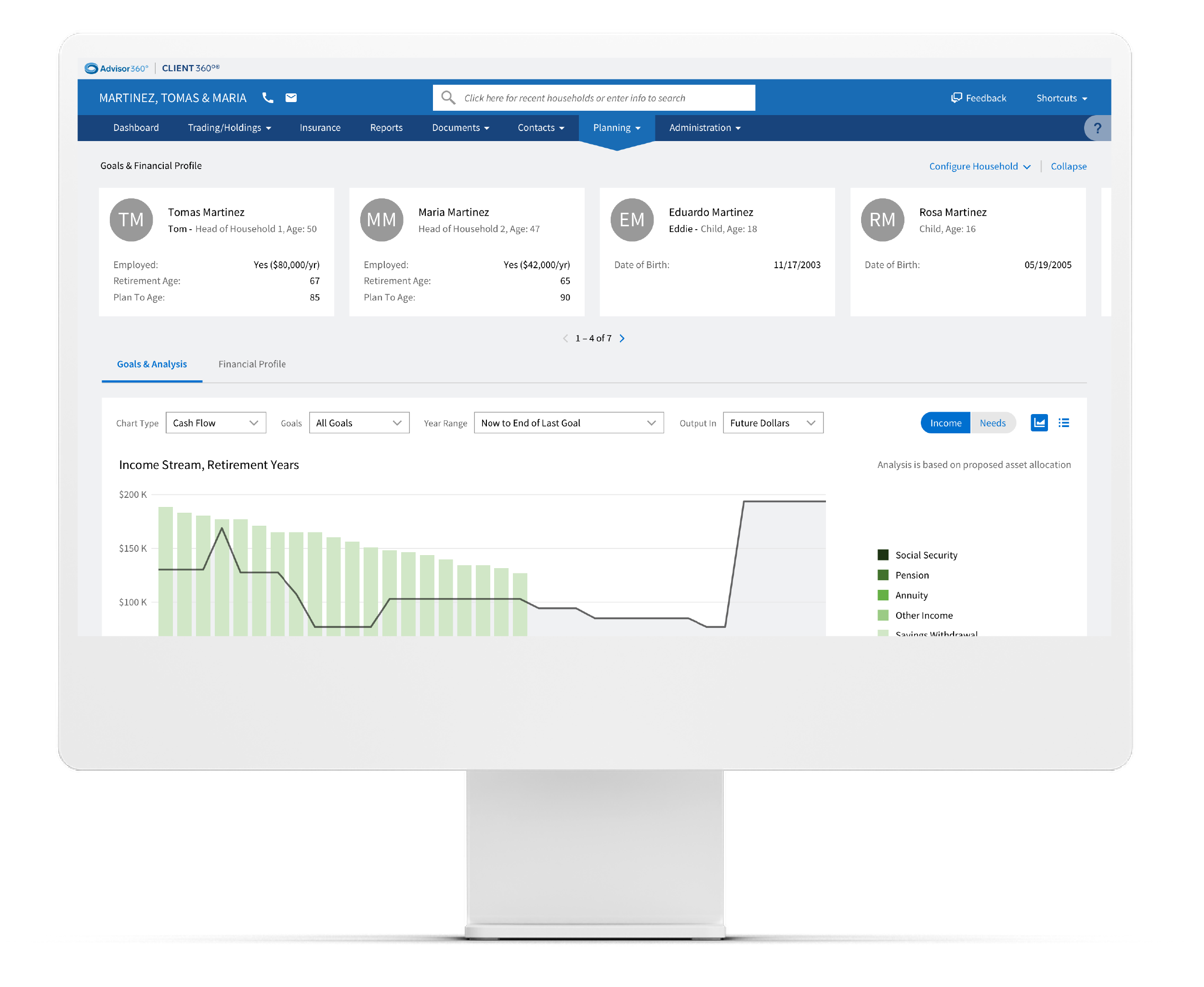

The CFP® board has outlined a seven-step financial planning process to help guide CFP certificates through the planning process with their clients and prospects. In this series of four blogs, I am going to show you how Advisor360°'s platform helps facilitate this process by providing efficiency and an enhanced client experience.

In this blog, I’m going to discuss step seven of the seven-step financial planning process: monitoring progress and updating.

The final workflow is about managing the relationship with the client and the seventh step is where you would monitor your client’s progress and update the plan with changes. This step consists of four tasks:

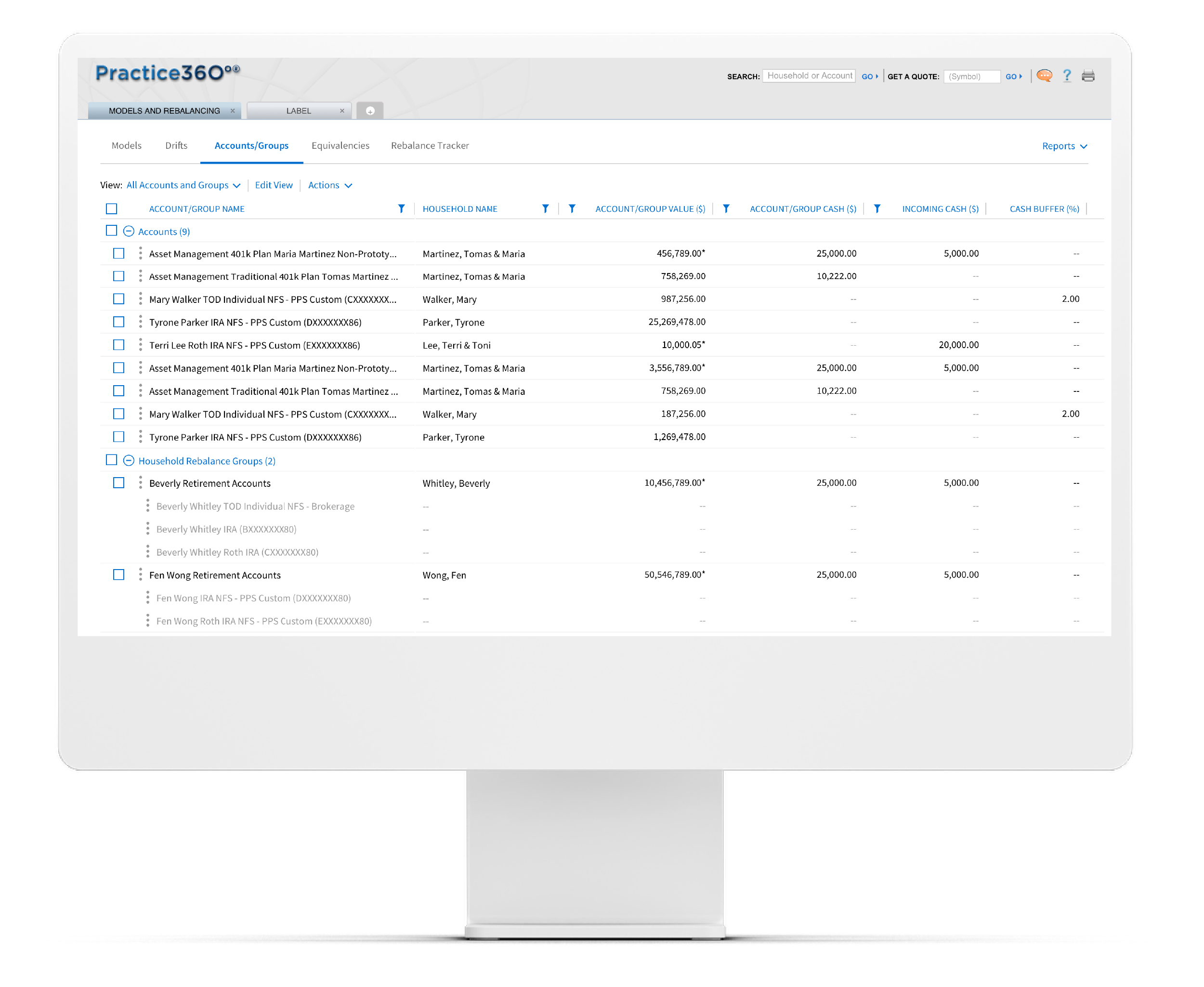

This first task overlaps with step six, using our Model Management tools to rebalance and drift reports to see where the client is.

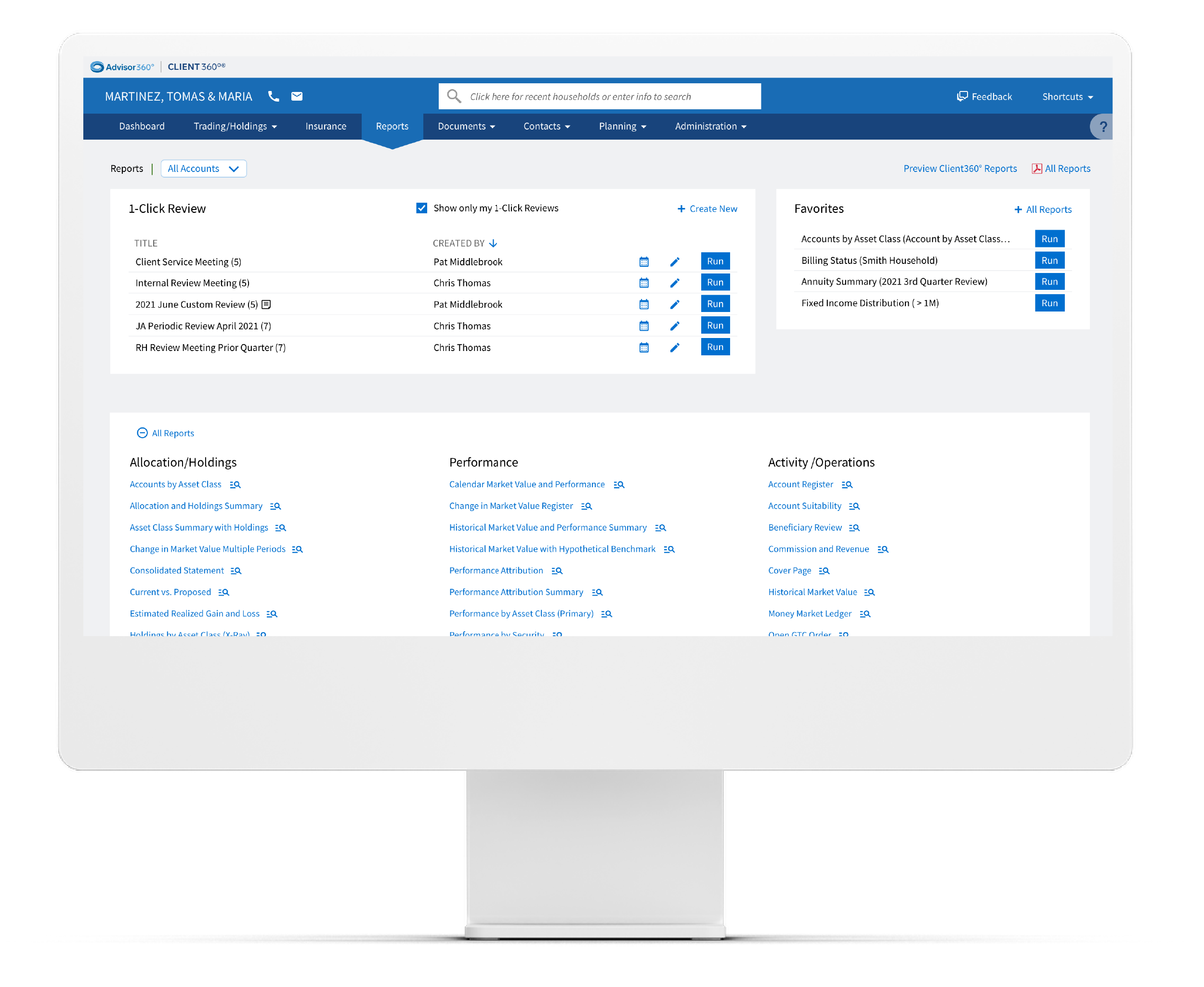

The second task is running an annual review with your client. We make this process easier with our 1-Click Review capability. We can bundle multiple reports and have them run in the same consistent format. Our 1-Click Review may include your asset allocation reports, performance reports, or beneficiary review reports. This is a way for you and your investor to review your progress.

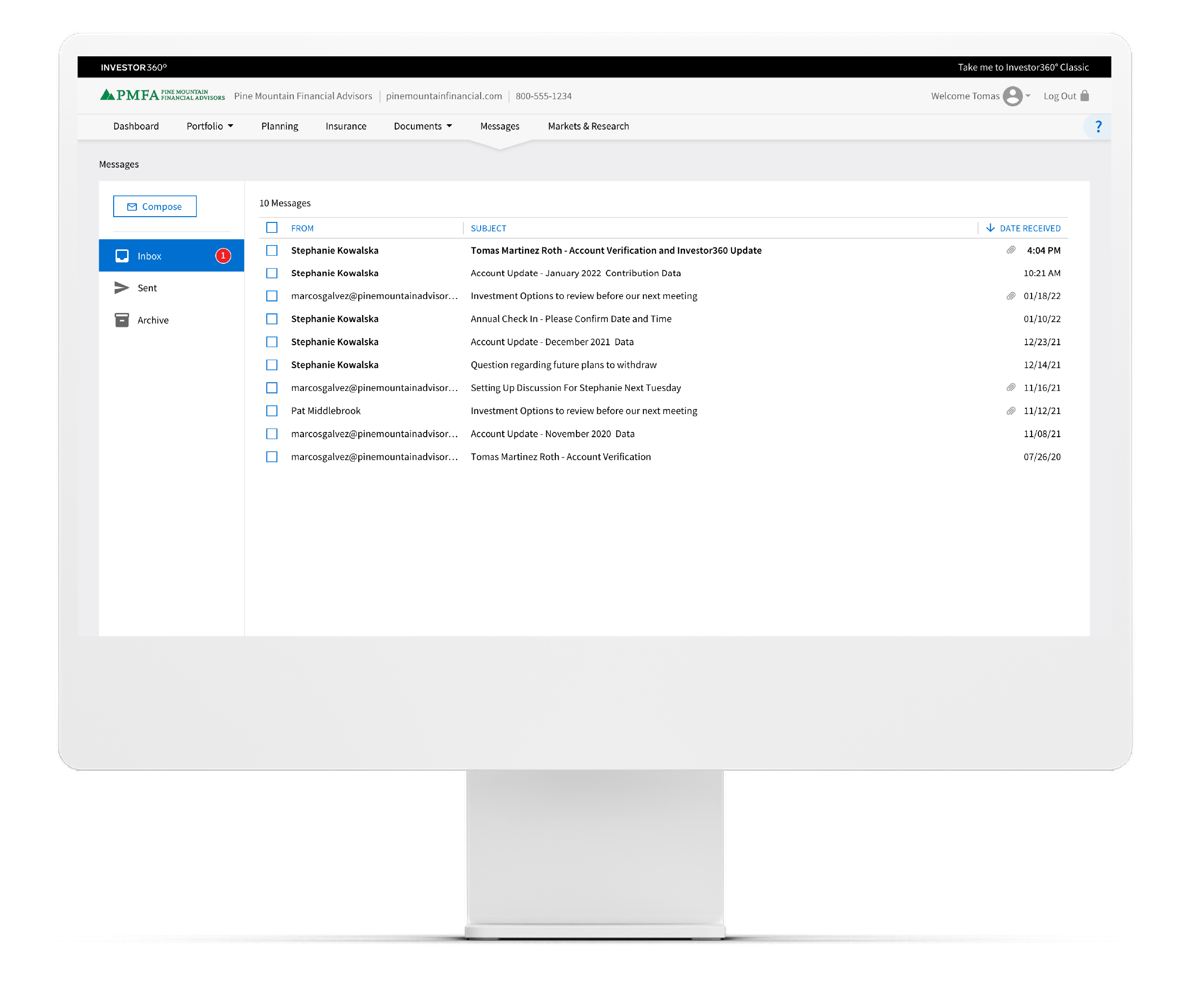

The next task is sharing all these reports using our secure messaging and document vault in the Investor360°® platform.

The Goals tab allows the user to easily refresh or edit the plan as life events happen and to measure how market activity has impacted the plan.

Patrick Noonan is Product Manager for Wealth Management and Insurance. Backed by his years of experience as a Certified Financial Planner (CFP®), Patrick defines and oversees product features that improve broker-dealer, advisor, and investor performance and efficiencies in the banking, investment, and insurance industries.

The RIA space is evolving—fast. Competition is fierce. Client expectations are rising. And AI is upending how advice is delivered. In this...

Picture this: You’re prepping for a client meeting—switching between several systems at once to locate client details, account balances, and...

According to our 2025 Connected Wealth Report, 85% of advisors believe generative AI will help their business—that’s up from 65% in 2024.