Advisors and AI: The Next Wave of Adoption

AI has already proven it can make advisors more efficient. The next phase of adoption will be defined by something equally important: trust.

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

The CFP® board has outlined a seven-step financial planning process to help guide CFP certificates through the planning process with their clients and prospects. In this series of four blogs, I am going to show you how Advisor360°'s platform helps facilitate this process by providing efficiency and an enhanced client experience.

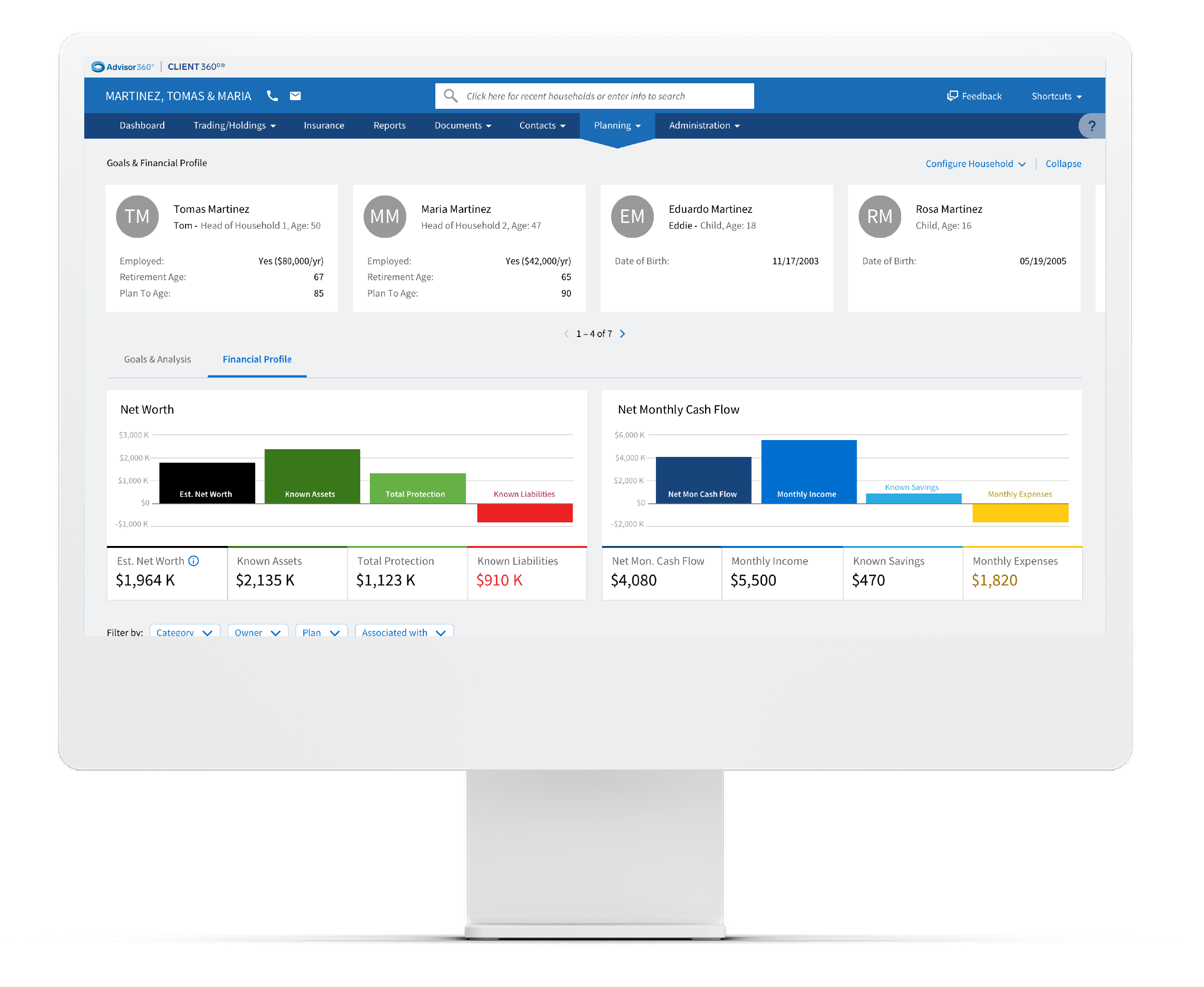

Last week, we discussed understanding your client’s personal and financial goals. Today, I will be covering the goals and planning processes of steps two, three, and four of the seven-step financial planning process.

The second step is identifying and selecting goals for the client. Now that you have gathered all this data, the next step in your workflow is to set up a meeting to identify financial goals with the client. Consider things like:

You would want to schedule that meeting and schedule a reminder to be sent to the client into your workflow.

The third step is analyzing your client’s current courses of action and potential alternative course of action. To do this, you would want to use our new Financial Planning tab under the Goals capability. This tab offers the ability to take the life circumstances that we have gathered in the previous step and bring them into our Goals tool. This financial planning engine runs an analysis to see if they're on track or if they need to readjust their plans or expectations. The engine will allow the user to add and/or edit cash flows and goals to find the best solution that both fits the client’s needs right now and their projected future needs and wants.

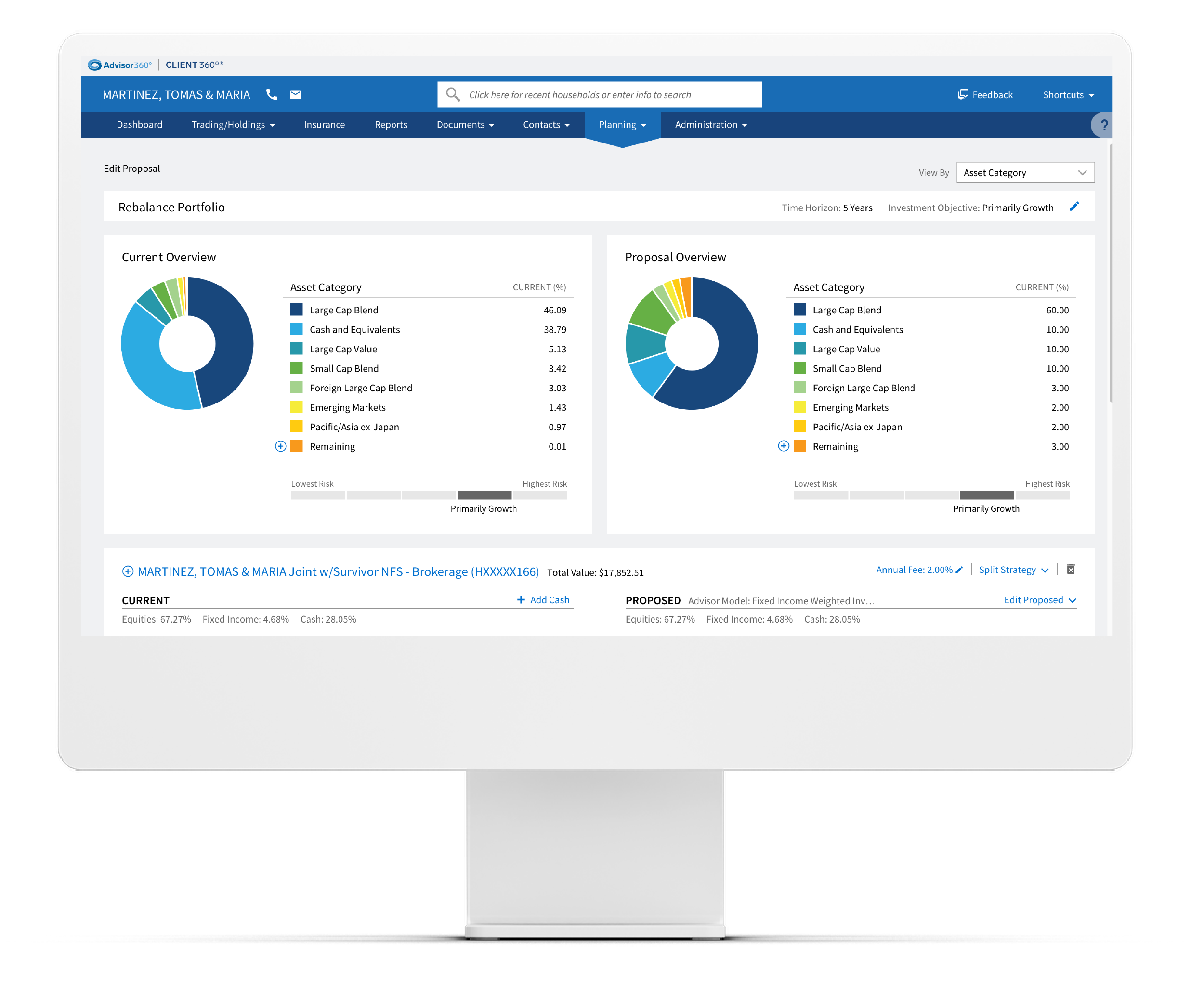

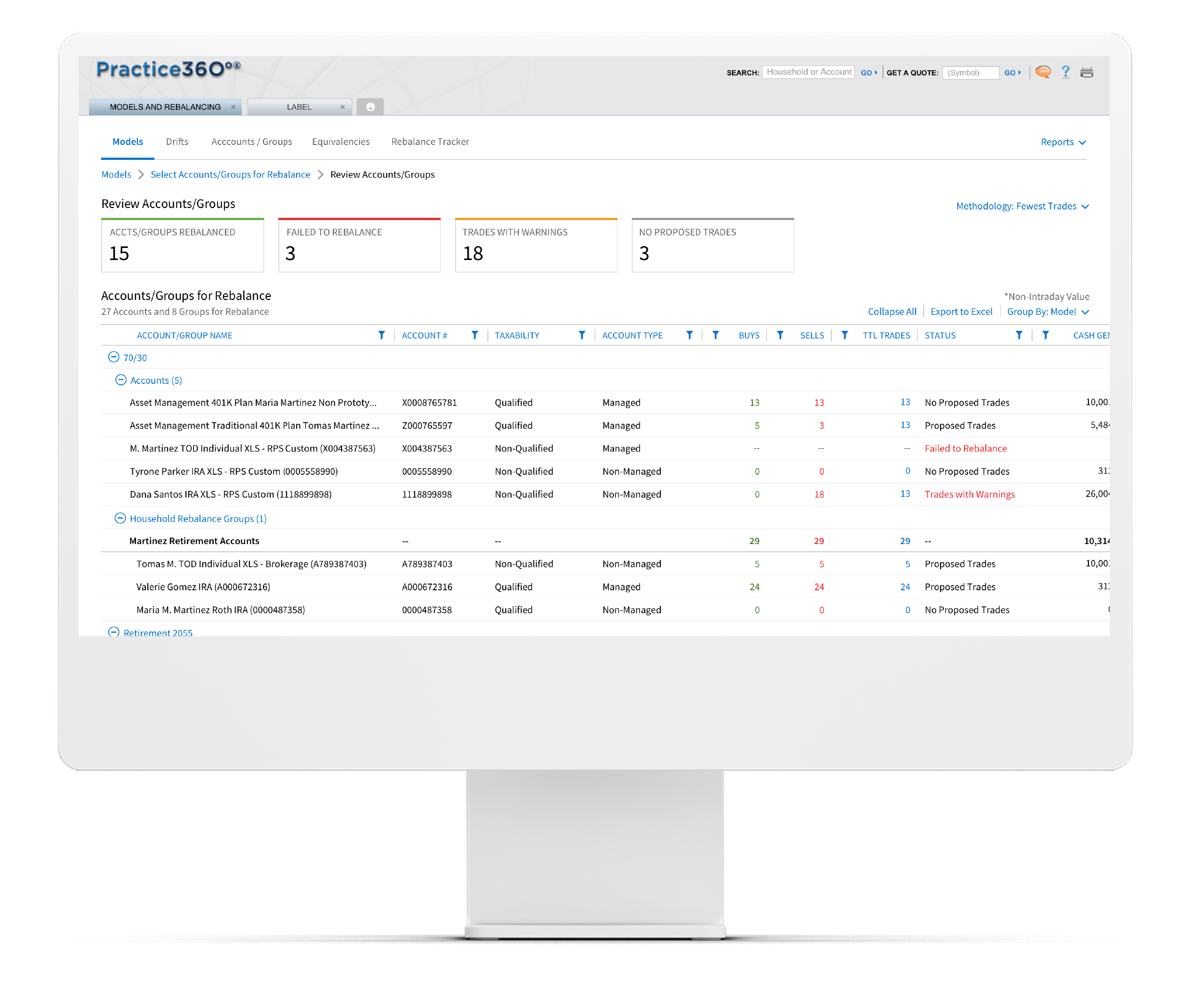

The fourth step is developing a financial planning recommendation. Here we can leverage our Goals integration with our Model Management tool to help better illustrate an asset allocation rebalance.

The Goals tool allows users to model standard asset allocation templates and integrates with our Model Management capability to bring in models made by the advisor, their firm, and third-party strategies. This enables the user to model their specific recommendation and illustrates to the client how this recommendation will impact their plan.

Now that we have successfully selected, analyzed, and developed goals for your client, the next steps are to present and implement these goals. These are steps five and six and will be covered in next week’s blog.

Patrick Noonan is Product Manager for Wealth Management and Insurance. Backed by his years of experience as a Certified Financial Planner (CFP®), Patrick defines and oversees product features that improve broker-dealer, advisor, and investor performance and efficiencies in the banking, investment, and insurance industries.

AI has already proven it can make advisors more efficient. The next phase of adoption will be defined by something equally important: trust.

The rationale for AI governance in fintech firms and how Advisor360°TM approaches roles, responsibilities, and enablement.

Last week, we shared an important milestone for Advisor360°: the launch of Advisor360° Wealth OS, our AI-native advisor experience designed to help...