Stop Settling, Start Scaling: Tech That Powers RIA Growth

The RIA space is evolving—fast. Competition is fierce. Client expectations are rising. And AI is upending how advice is delivered. In this...

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

In this conversation, Patrick Noonan, Sr. Product Manager for Wealth Management and Insurance, and Collin Ross, Product Manager at Advisor360°, have an in-depth discussion on the vital topic of advisor transitions. Learn about the intricacies of moving advisors between firms, the challenges involved, and how technology can streamline this critical process for firms, advisors, and their clients. Discover the latest trends and strategies to ensure smooth transitions, minimize client disruption, and enhance overall efficiency.

Colin Ross: Advisor transitions are a hot topic in the market today.

Patrick Noonan: Absolutely. We've discussed onboarding new clients and advisors in the past, but today we'll focus on advisors joining new firms. It's a significant event, often involving moving their entire book of business to a new custodian. According to FA Magazine, 10,000 advisors switched firms last year, a 7.5% increase from the previous year. Clearly, it's a prevalent activity.

Colin, could you explain what an advisor transition involves?

Colin: Certainly. Advisor transitions are becoming more common for several reasons, including better services, technology, financial incentives, and more flexibility. From an industry perspective, transitions became more standardized with the creation of the Broker Protocol in the mid-2000s, reducing litigation and facilitating movement between firms.

Over the last decade, there has been significant growth in the RIA market, with a 2% yearly growth in the number of firms and a 5% yearly growth in the number of advisors. By 2027, RIAs are projected to control around a third of the market.

Patrick: Moving an advisor's book of business is a huge undertaking. What are some key challenges in this process?

Colin: Each persona in the process faces unique challenges. For firms, a large volume of incoming paperwork requires scalability and technology solutions to streamline account opening and funding through automation and integrations. Advisors must navigate regulations regarding client contact, often unable to notify clients until after they've joined the new firm.

The type of transition—protocol or non-protocol—impacts how much client data they can take with them, influencing their ability to prepare and retain clients. Investors, often caught by surprise, face unexpected time requirements and disruption, making efficient interactions crucial.

Patrick: I recall my own transition experience 15 years ago, which involved significant planning and preparation. What specific pain points do advisors encounter?

Colin: Advisors face regulatory challenges, especially regarding client contact. In a protocol transition, they can take some client data, aiding preparation and efficiency. In a non-protocol transition, they gather data post-join, often leading to a race to retain clients. The process involves contacting clients, gathering data to establish and fund accounts, and adjusting to new systems. Investors, meanwhile, experience disruption and unexpected time demands, making a smooth and efficient transition critical.

Patrick: How is Advisor360° helping with the transition process?

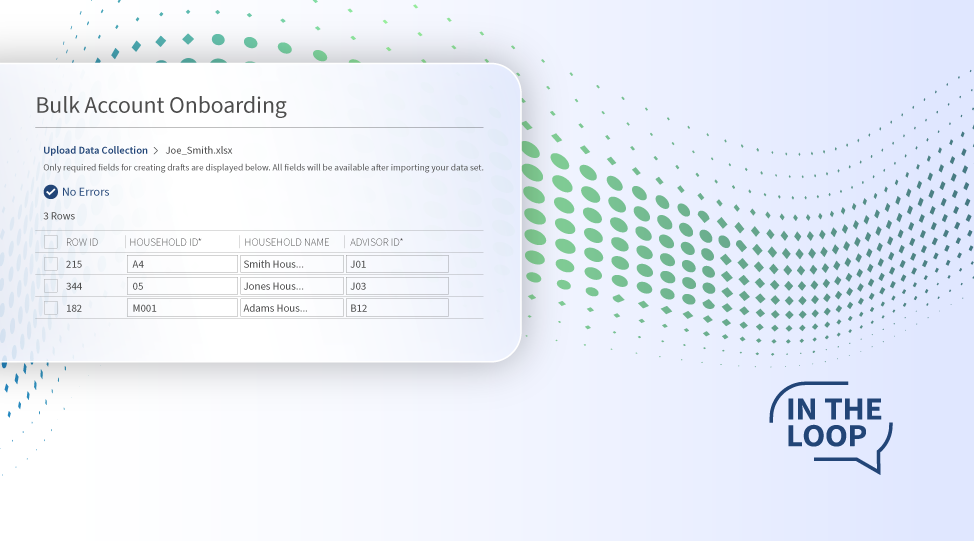

Colin: Our Account Transition tool aims to make the process seamless. It allows for data collection in a spreadsheet, supporting protocol advisors' preparation and speeding up data collection. The tool can import thousands of accounts simultaneously, creating draft records within our account opening tool and automatically generating CRM contacts and households.

Validations ensure accuracy and compliance, and post-signature processes support indexing, account updates, and document submission to custodians. Our goal is to minimize manual tasks and focus on clients' financial well-being.

Patrick: Speed is crucial in transitions to minimize disruption for clients. What’s on the roadmap for Advisor360° to further improve this process?

Colin: We’re looking to support more custodians to give firms more choice, improve account funding times through better integration with custodians, and enable investors to contribute more independently to the process. This way, we accommodate busy lives and reduce disruption.

Patrick: With the growing RIA market and frequent advisor transitions, our Account Transition solution makes this process easier and benefits everyone involved.

If you'd like to learn more about Advisor360°, please visit our website at www.advisor360.com.

Patrick Noonan is Sr. Product Manager for Wealth Management and Insurance. Backed by his years of experience as a Certified Financial Planner (CFP®), Patrick defines and oversees product features that improve broker-dealer, advisor, and investor performance and efficiencies in the banking, investment, and insurance industries.

The RIA space is evolving—fast. Competition is fierce. Client expectations are rising. And AI is upending how advice is delivered. In this...

Picture this: You’re prepping for a client meeting—switching between several systems at once to locate client details, account balances, and...

According to our 2025 Connected Wealth Report, 85% of advisors believe generative AI will help their business—that’s up from 65% in 2024.