2 min read

A wake-up call for wealth advisors: the consequences of bad tech

Jeff Schwantz

:

2/15/24 1:46 PM

Jeff Schwantz

:

2/15/24 1:46 PM

Today's advisors expect to have tools at their fingertips to prospect for clients, maintain existing relationships, develop financial plans, and grow professionally. Our research uncovered a direct link between advisor retention and technology. Enterprise wealth managers that forgo important investments in tech platforms, including those devoted to building financial plans and client onboarding, stand a far greater risk of watching quality talent walk out the door. Having seen trends come and go within the financial services industry, I continue to believe that success lies in the ability to adapt and embrace what the latest technological advances can deliver.

As part of the 2024 edition of our award-winning Connected Wealth Report series, we surveyed 300 financial advisors and executives at enterprise wealth management firms in the U.S. to identify emerging opportunities as well as potential problems cropping up across the wealth management landscape now and in the year ahead.

Download the reportAdvisors fleeing outdated tech

Advisors are increasingly aware that gaps in technology have a direct impact on their livelihood and value of their practice. According to our survey, a vast majority of advisors said they would switch firms over a weak technology stack. Nearly half confirmed they had already left an employer because of lackluster technology. Another sobering reality1: nearly 11,000 advisors representing more than 156,0001 years of experience left their firms from January through September of 2023. That attrition is expected to surpass 2022, when nearly 11,300 advisors representing more than 184,000 years of experience departed. This leaves enterprise wealth firms with a clear question—can we afford to not make an investment in the right technology and let our advisors walk away and go somewhere else that does?

Clients are following suit

It’s not only advisors on the move, but today’s clients are also voting with their feet. Most respondents report having lost clients and prospects due to bad technology. Stated plainly, neglecting quality onboarding solutions, marketing and prospecting tools, client portals, and communication prowess has its consequences. The time is now to devote resources to innovative platforms, tools, and solutions.

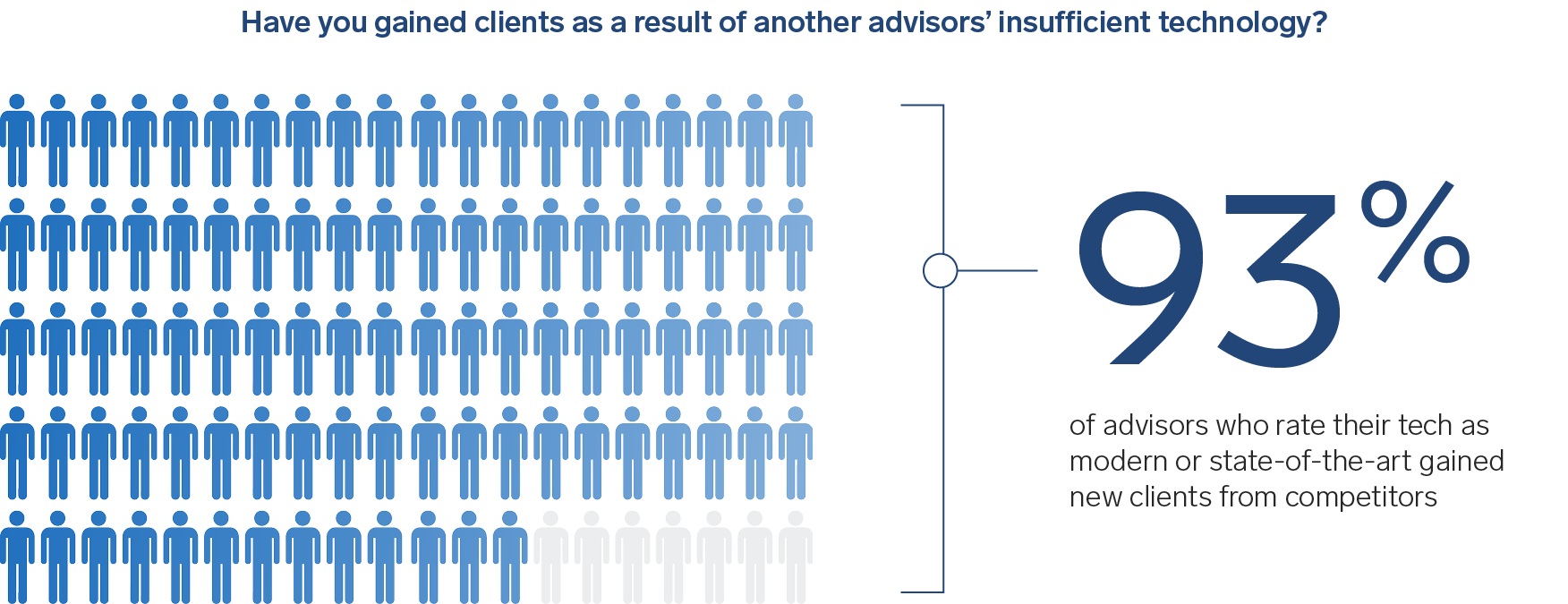

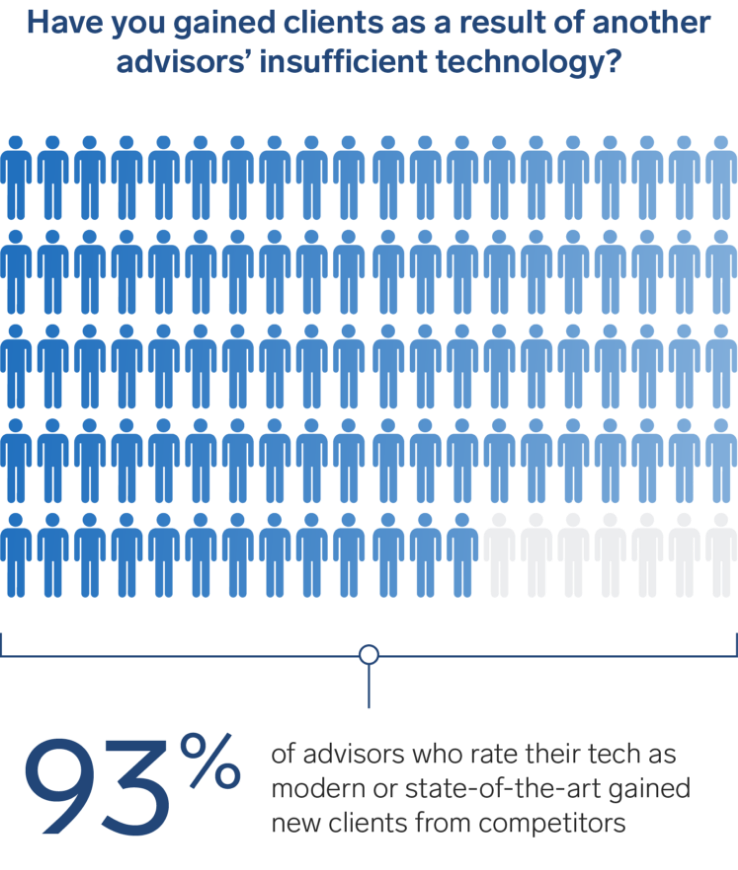

Where there’s risk, there’s opportunity

The news is not all bad by any measure. There is more opportunity than ever, and technology plays a big role in building new business. The advisors we surveyed report gaining new clients due to another advisor’s lackluster technology. In fact, 93% of advisors who rate their tech as modern/state-of-the-art say they’ve acquired clients from competitors. In other words, technology is a big part of what separates satisfied clients from the rest. The subtext is that employing a flexible, end-to-end wealth management platform is the best way for advisors to dramatically improve their level of client service while increasing their overall productivity. Companies prioritizing powerful tech platforms have the chance to enjoy outsized AUM gains along with acquiring the industry’s top talent.

The bottom line

I’m encouraged and excited that advisors understand how crucial tech is to drive productivity and improve the value of their practice. The message they are sending is loud and clear—they are looking for increased efficiency across client onboarding, marketing, prospecting, financial plan development and more.

Here’s an approach that works: Ask advisors about their pain points, examine your current client-facing technology, and leverage emerging leading-edge tech solutions. This process can not only plug gaps but also help firms gain a measurable competitive advantage. Meanwhile, enterprise solutions, driven by generative AI, will almost certainly bring about increased productivity allowing companies to grow AUM at scale. Get ready for a whole new normal.

Jeff Schwantz is CRO at Advisor360°, responsible for leading the Sales and Marketing teams and guiding the company’s revenue generation strategy/execution and go-to-market approach.

1. Discovery data (MarketPro) from January to September 2023. Comparison of prior firm to current firm. Excludes firms that were acquired or those who merged legal entities.