Advice360° is a series designed to help advisors increase their productivity using our digital wealth management software.

In this installment, Patrick Noonan, Advisor360°’s Sr. Product Manager for Wealth Management and Insurance explains how our solutions can help unlock advisor productivity throughout the wealth management process.

Today’s financial advisors do a lot of juggling. From growing their book of business, to onboarding clients, and creating financial plans—their workload can be cumbersome unless they have technology that’s built to deliver efficiency. That’s where Advisor360° comes in. We help wealth managers unlock their productivity potential, one solution at a time.

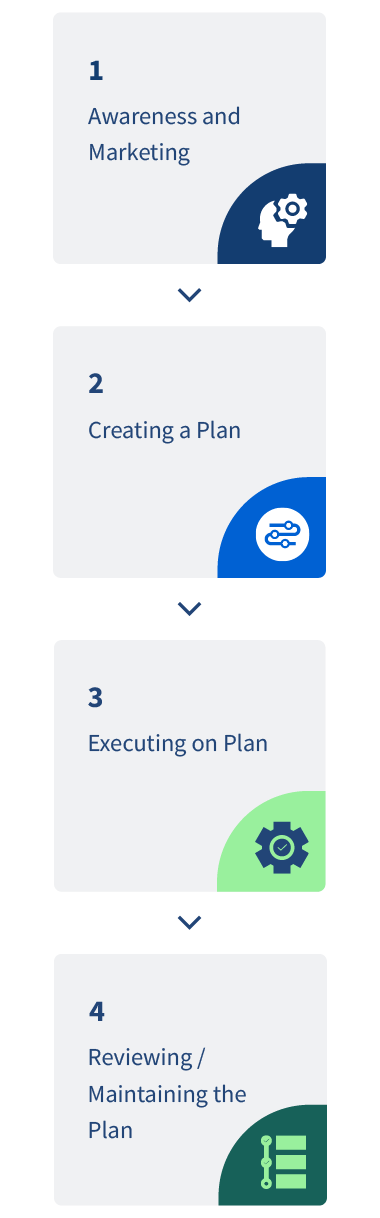

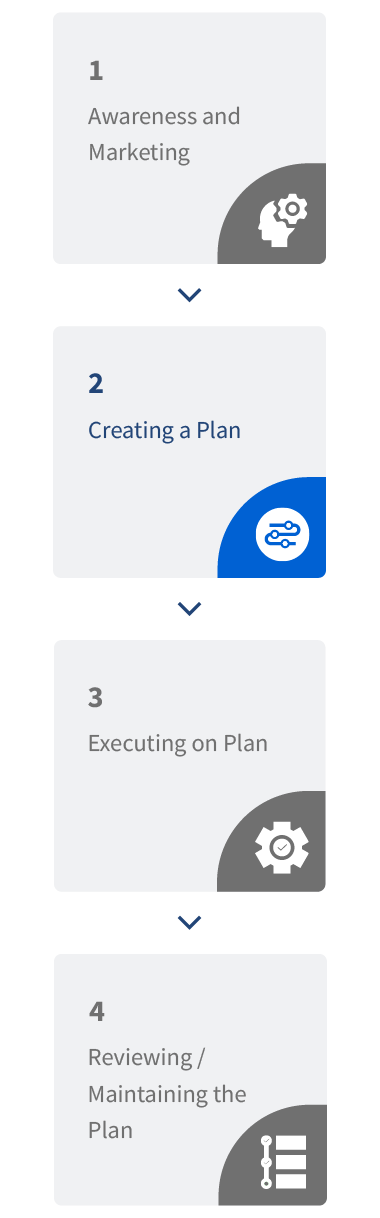

The average advisor’s workload can be organized into four common workflows—and we have productivity solutions for all of these.

Today, we’ll focus on the first two workflows—Marketing and Awareness and Creating a Plan—to illustrate how our solutions provide a uniquely streamlined approach to give advisors a productivity edge. Next time, in part two of the series, we’ll move on to Executing a Plan and Maintaining a Plan.

Awareness and Marketing

Prospecting is an advisor’s bread-and-butter. Without a robust pipeline of leads that are nurtured and converted into new business, an advisors’ client list eventually thins out. Our Advisor Experience solution provides a suite of integrated capabilities and features to help advisors market their services to prospects efficiently and effectively. For instance:

- WealthGuide: Advisors can showcase their financial planning process, the wide breadth of areas they cover, and niches they specialize in by showing prospective clients WealthGuide—our comprehensive financial planning tool—leveraging it as a powerful marketing piece that puts on display all of the services they offer.

- Marketing Integrations: We bring in data and practical tools from our partners—such as FMG—that advisors can use to drip marketing materials to potential clients, keeping them consistently engaged.

- Leads: Easily enter potential clients into the CRM using our leads system, helping advisors keep track of prospects. Segment leads by type or profile to help advisors effectively market to them.

- Data: Leverage comprehensive data throughout the workflow, enabling more informed decision-making for advisors.

Creating a Plan

Once a prospect becomes a client, advisors shift into Creating a Plan. In this case, our Client Portal solution provides a user-friendly, streamlined interface for clients to actively participate in their financial journey. These are just some of the key functions our accessible Client Portal delivers:

- Client Data Entry: Save time by having clients input their financial information directly into the client portal, reducing the amount of information advisors need to track down and enter.

- Account Aggregation Services: Boost productivity by seamlessly consolidating financial accounts into a single view. Housing all accounts on one page can be a quick and significant win with clients. The client portal can sync employer-sponsored plans with updated holdings information.

- Document Vault: Bypass the old-school method of having clients provide physical documents or scans by email with our Document Vault, alleviating manual entry by the advisor’s staff.

- Secure Messaging: Foster collaboration between the advisor and client by utilizing our built-in secure messaging features.

Once a client is engaged on our client portal, the focus turns to creating a personalized financial plan based on their unique values, needs, and goals. Here’s where WealthGuide transitions from a marketing tool into a planning tool by quickly gathering and sorting data to aid in the plan-development process. Advisors are also able to take comprehensive notes during meetings, housing all the client’s details in one place.

As part of the Advisor Experience solution, advisors can leverage our goals tool—or one of our many integrations like RightCapital—to create, review, and monitor a client’s plan. Our handy proposals tool allows advisors to make recommendations—such as a different asset allocation strategy—to help keep investors on track with their goals. Our platform also utilizes data previously collected from our leads system, Client Portal, and WealthGuide—saving advisors valuable time and effort by eliminating manual entry and ensuring the data is uniform and up-to-date.

And for clients seeking portfolio management services, our Managed Accounts solution offers advisors a convenient option for asset management. Advisors can manage clients' portfolios directly within our platform, all in one place, vastly simplifying account management.

Going a step further, advisors do not need to use a generic asset allocation model within our goals or proposals tools. Our Managed Accounts solution has the flexibility to bring in models and strategies from outside the system, displaying the model within the plan and saving time on data input.

The Bottom Line is Productivity

Advisor360° unlocks productivity throughout the wealth management process. From the Awareness and Marketing phase to Creating a Plan, our solutions simplify processes and allow advisors to maximizing efficiency and provide greater value to their clients. Our simplified advisor workflow is a productivity game-changer when it comes to practice management and client engagement.

Patrick Noonan is Sr. Product Manager for Wealth Management and Insurance. Backed by his years of experience as a Certified Financial Planner (CFP®), Patrick defines and oversees product features that improve broker-dealer, advisor, and investor performance and efficiencies in the banking, investment, and insurance industries.

Patrick Noonan

Patrick Noonan