3 min read

FinTech Conversations: What to Know About Our Envestnet Integration

Patrick Noonan

:

5/16/24 1:27 PM

Patrick Noonan

:

5/16/24 1:27 PM

In this installation of FinTech Conversations, Patrick Noonan, Sr. Product Manager for Wealth Management and Insurance, and Meredith Connell, Sr. Product Manager of Wealth Management at Advisor360°, discuss how our platform seamlessly integrates with Envestnet to streamline workflows, processes, and general productivity across the practice.

Advisor360°’s Approach to Integration

Patrick Noonan: Can you talk about Advisor360°'s approach to integrations, our ecosystem, and why partnerships are so important to us?

Meredith Connell: We've seen such a wave of innovation and new products in the fintech space over the past few years, and there doesn't seem to be any signs of slowing down, especially as the landscape continues to evolve.

As we see major advances in areas like AI and machine learning, I think the quantity and types of opportunities to leverage new technology will only become greater. At Advisor360°, we have a wide range of integration partners that we interact with in a variety of ways.

There's so much value in partnering with others in our industry to create cohesive workflows and experiences for our mutual clients rather than trying to solve problems that others may have already solved.

Advisor360°’s Envestnet Integration

Patrick: Can you talk about our Envestnet integration and how we’ve seen it impact our users?

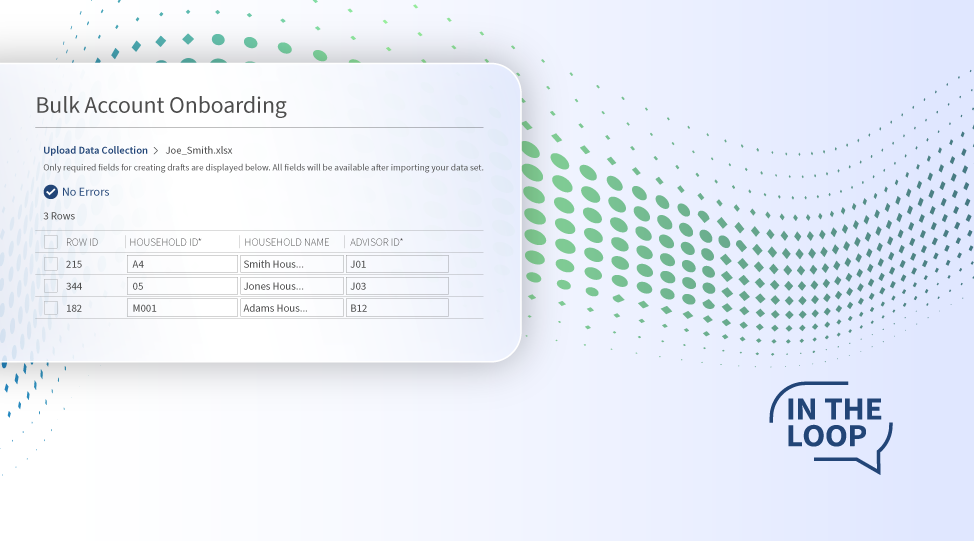

Meredith: Last year, we partnered with Envestnet to create a seamless new client onboarding process for advisors and firms who conduct advisory business. Advisors and their staff can start on the Advisor360° platform—the home base for our users' daily activity. From there, they can easily launch into Envestnet's next-gen proposal tool and follow an intuitive process to generate an investment proposal.

Once the advisor completes the proposal setup process, which includes identifying the type of investment—whether SMA, UMA, or mutual fund strategist—and then selecting specific models, fees, and other pertinent information, they can then jump directly into Advisor360°'s Digital Onboarding solution with the click of a single button.

Once the user lands on the Advisor360° platform, we're pulling and identifying all of the relevant information that was just provided on the proposal in Envestnet, and bringing it into the new account opening process, which brings a few key benefits for advisors.

One key benefit is that the proposal data is automatically prefilled. This prevents NIGOS and duplicate data entry, speeding up the new account opening process. Another benefit is that we pull in and populate investment-generated forms and disclosures.

Things like the statement of investment selection and money manager ADBs—those are pulled from the Envestnet system automatically into the forms bundle at the end of the Advisor360° account opening process. All the forms that are needed to successfully create an account—whether it's custodial forms, account funding forms, or Envestnet forms—are seamlessly packaged together into one cohesive e-signing event for the client.

There are other great benefits that the advisor can take advantage of once they're in Advisor360°'s digital onboarding. One example is our multi-account opening capability. If you wanted to open up multiple proposal-based accounts, or if you wanted to create a commission-based account or a direct investment—such as a variable annuity—along with that Envestnet-driven account, advisors can package all of those up in one single account-opening event. This creates additional efficiencies for households that may be looking to onboard a number of different types of accounts at the same time.

Since launching this integration, we've received great feedback from our mutual clients. One of the most notable data points is time savings. A recent survey we conducted at Advisor360° found that virtually all of the users that participated saw a decrease in the amount of time it takes to open up advisory accounts compared to their former solution.

A third of those surveyed told us that they found a time savings of 10 to 20 minutes per account when comparing the Envesnet-Advisor360° account opening process to their prior solution. Our simple-to-follow but highly integrated solution can bring tangible efficiencies to advisors and their practice. And the feedback that we've seen so far confirms that.

Filling Additional Needs with This Partnership

Patrick: What are other areas where the Envestnet integrations comes into play?

Meredith: One is that we leverage manager and sleeve-level performance information and data from investment to power some of our SMA- and UMA-specific reports on the Advisor360° platform. And those nicely complement our suite of household and practice-level reports available throughout our Advisor360° platform.

We also have an integration between Advisor360° and MoneyGuidePro® that allows you to pass advisor data and client information into MoneyGuidePro to kick off that planning process. Another example is our Envestnet integration with Yodlee®, which supports account aggregation capabilities in our investor portal. These are just a few of ways we're trying to remove friction, create efficiencies, and collaborate with some great partners to create great integrations for our advisors and users.

Patrick: Thank you for talking about the importance of our partnerships. If anyone is interested in learning more about Advisor360°’s partnerships or other offerings, visit us at www.advisor360.com.

Watch the full version here

Patrick Noonan is Sr. Product Manager for Wealth Management and Insurance. Backed by his years of experience as a Certified Financial Planner (CFP®), Patrick defines and oversees product features that improve broker-dealer, advisor, and investor performance and efficiencies in the banking, investment, and insurance industries.