Too many NIGOs

Complicated data collection requirements result in costly NIGO (Not in Good Order) submissions, dramatically increasing processing time.

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

Remove cumbersome processes with an efficient wealth management solution that speeds up the account opening process.

Advisor360°’s award-winning solution accommodates your firm’s specific requirements, reducing the amount of NIGOs and time spent processing data.

Watch this video (1:36) to discover how our Digital Onboarding solution can create more meaningful client-advisor collaboration.

Have you or your advisors ever experienced any of these problems?

Complicated data collection requirements result in costly NIGO (Not in Good Order) submissions, dramatically increasing processing time.

Lengthy manual form fills from multiple systems slow down the onboarding process. When systems ask for irrelevant information that’s been provided elsewhere, data errors and inconsistencies start to arise.

Disconnected point solutions require multiple logins in separate tools to open accounts, creating an inefficient process.

Account-related forms are conveniently sent individually to clients rather than in a bundle.

Manual processing of suitability review requires multiple steps by the home office for account approval without a central process.

Keeping up to date with new regulations is time consuming and costly.

Advisor360°'s platform is built to support enterprise wealth firms regardless of their affiliation, fee structure, or custody and clearing arrangements. Our data integrations with all major custodians have laid the foundation for fast, straight-through processing that results in increased productivity and growth.

For advisors: seamless onboarding at a new firm, improved daily workflows.

For clients: a fast and simple account opening process and reliable reporting.

For the home office: operational efficiencies in trading and reporting, data management, etc.

Enhance your tech stack with seamless, advanced account opening integration.

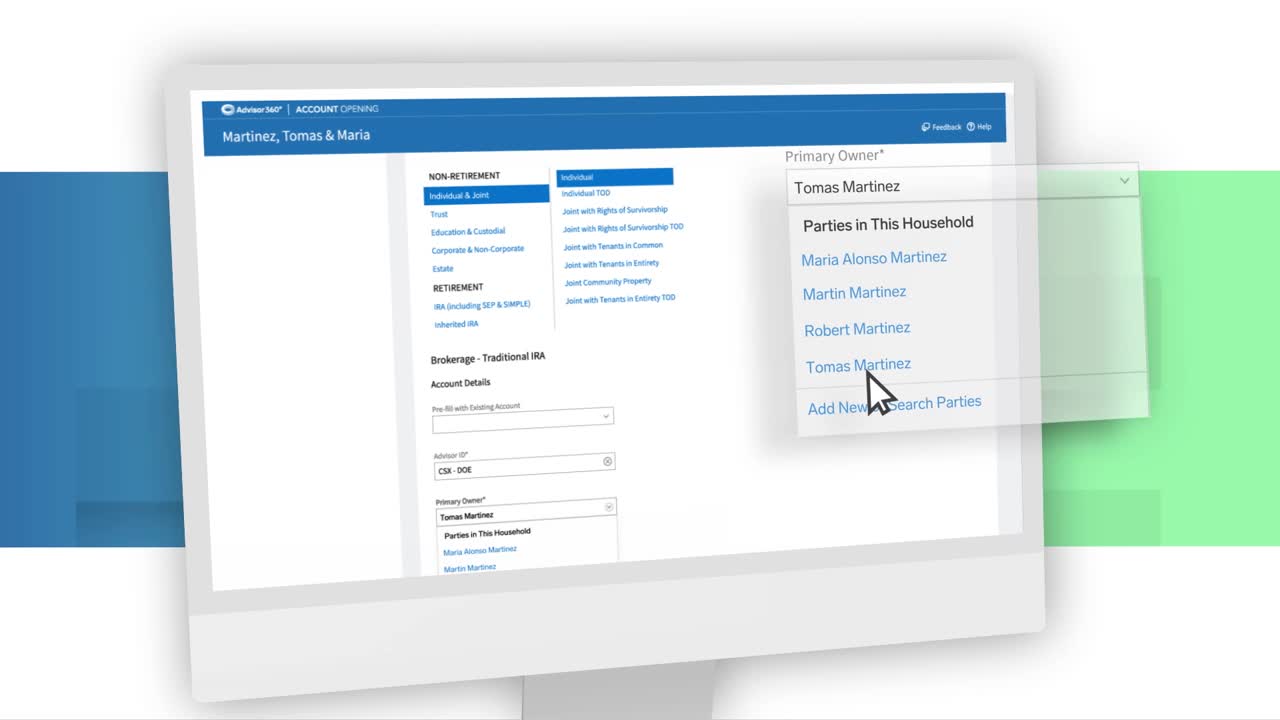

Our award-winning Digital Onboarding solution streamlines the account opening process with straight-through processing and multi-custodial support. With a configurable interface, automatic pre-fills, and minimal data entry, advisors are able to open insurance, annuity, and investment accounts in only a matter of minutes. Configurable data collection and validation enrich the experience, minimizing processing exceptions and eliminating NIGOs.

“We’re gratified to be recognized – again – by WealthManagement.com as the industry leader in onboarding innovation. It’s a testament to our relentless commitment to continuously improve our offerings for advisors and their clients.” – Mike Fanning, CEO of Advisor360°.

“The proposed Advisor360° Onboarding and NAO (new account opening) application will be transformative. The solution will resolve one of the most pressing industry pain points.”

In-depth analysis of Advisor360˚’s Digital Onboarding solution conducted by Celent’s Head of Wealth Management, Jean Sullivan.

I opened my first account yesterday—an IRA—and Digital Onboarding is a game changer!

Joan Bernardi | Crabtree Financial Services

There is no debate, advisors agree that digital onboarding is a significant contributor to not just the future of wealth management but the present. See how you stack up against your peers.

Learn more about the complete wealth management experience.

Learn more about our Digital Onboarding capability.