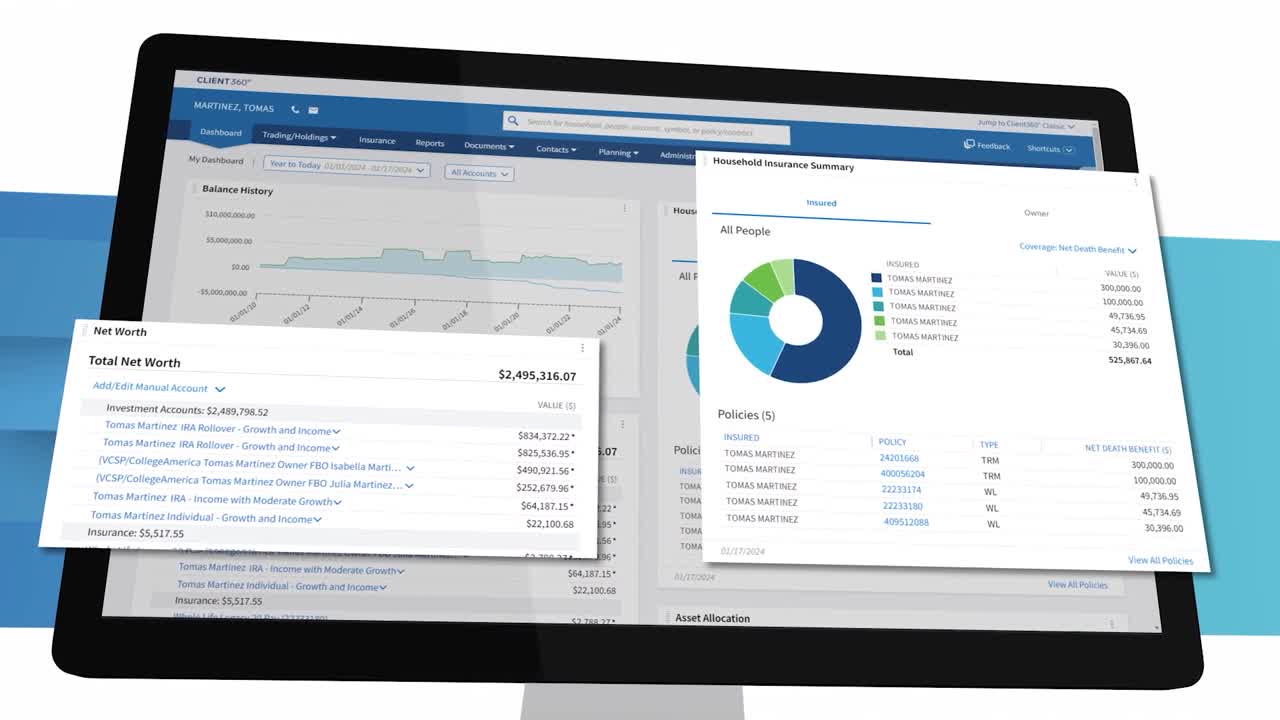

Real-time account values

Provide advisors and clients with real-time account balances and positions. As we process different data sources throughout the day, our platform and team are updating accounts to reflect the latest values.

Solve your current pain points with our award-winning solutions.

Increase automation with our modern wealth platform.

The leading end-to-end wealth management platform.

Our team works to anticipate and surpass our clients’ expectations.

Merge our open, integrated platform and its solutions into your tech stack.

The #1 reason advisors switch firms is the desire for better technology.

Bundle, schedule, and run fully reconciled reports with our wealth management reporting solution and trusted data.

Financial professionals affiliated with MassMutual typically save hours each week using 1-Click Reviews® when preparing reports for client meetings, which has profoundly improved their level of service to their clients as well as their overall productivity.

John Vaccaro | Head of MassMutual Financial Advisors

61% of financial advisors agree that “bad data” is the primary obstacle they face today.

Pair Advisor360°’s high-quality, scalable data with our reporting solution to drive smart, decisive business decisions.

Watch this (1:54) video to see how Advisor360° is working to overcome this industry-wide issue.

Have you or your advisors ever experienced any of these problems?

Provide advisors and clients with real-time account balances and positions. As we process different data sources throughout the day, our platform and team are updating accounts to reflect the latest values.

Our platform enriches and normalizes data from hundreds of unique sources, consolidating it into a unified layer for reporting and for advisors and clients to see consistent information regardless of where assets are held.

In addition to our robust automation system, Advisor360 offers a dedicated team to assist in the review and upkeep of client and account data.

With a single client record, advisors can eliminate duplicate data entry. Our integrations ensure that downstream tools leverage the same client data to provide a single, holistic picture while assisting in reporting needs.

When onboarding advisors, our platform can maintain and translate that advisor’s legacy data, allowing advisors to retain their book of business and transaction history.

Our SOC-2 and HIPPA-certified platform takes a pragmatic, risk-based approach, ensuring the integrity, safety, and security of your environment.

What makes Advisor360°’s data different.

Utilizing automation, Advisor360° Unified Data Fabric™ (UDF), a proprietary data model, organizes and enriches data nightly from custodians, DTCC, DAZL, TAMPs, and hundreds of financial institutions and millions of client accounts.

The result is a holistic, easily accessible data layer that remains consistent across all products—from annuities to investments to insurance—in a single dashboard that drive more accurate, trusted insights.

Our Unified Data Fabric® consolidates all types of data from hundreds of sources—allowing your advisors to combine investment and protection products into proposals, financial plans, and reporting with one click of a button.

Discover how our 1-Click Review reporting solution can create more meaningful client-advisor collaboration.

Discover how a holistic, accessible data layer improves advisor satisfaction, retention, and productivity.