What makes us different

Deliver a more connected digital wealth experience

Provide a comprehensive and unified approach to managing the digital wealth experience for your advisors.

Advisor360° provides clear differentiation to our clients

We enable broker-dealers to manage, act, and innovate the digital wealth experience.

Manage

Manage the digital wealth experience on a unified platform

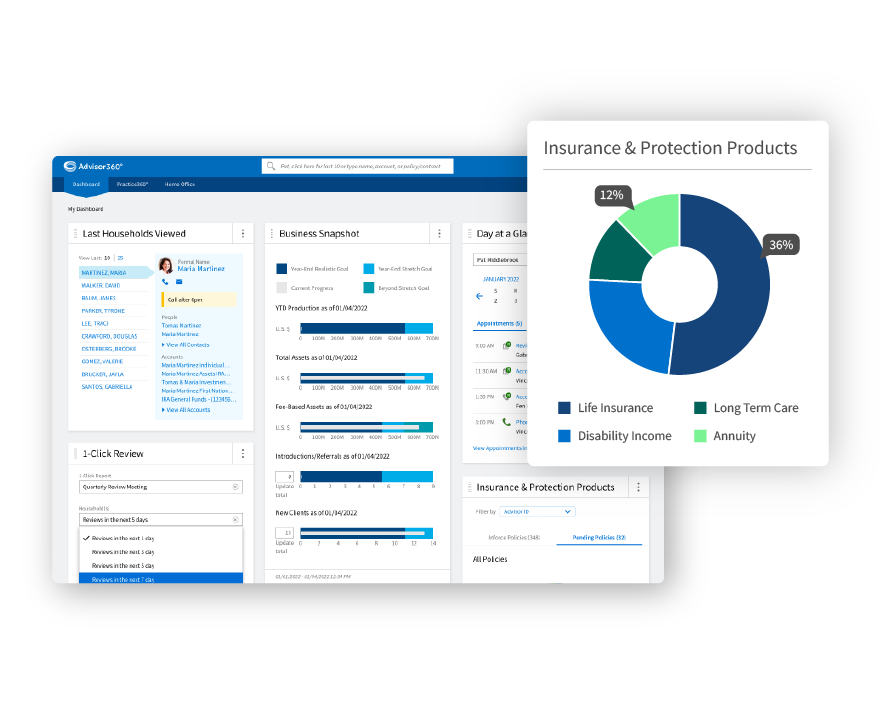

Our platform manages the wealth needs of all stakeholders across all lines of business while integrating with your existing technology footprint to provide a rich and unified approach to digital wealth management. We provide:

- A holistic stakeholder view: Serve the varying and complex needs of all your stakeholders—broker-dealers, advisors, and clients—in a single platform.

- Unified products: Manage all your wealth management products—from investments to banking to insurance—through a single, unified experience.

- An industry-leading ecosystem: We have built-in technology integrations and APIs that work with your existing technology stack to create a seamless experience.

Act

Drive better outcomes with technology purposely built for the digital wealth experience

Decisions and results cannot come from data that is inconsistent and disconnected and from software that is hard to manage and use. Our technology leverages a proprietary approach to simplify and unify your data while our configurable development model and intuitive applications speed up your time to market and empower smarter, faster decisions.

- Time-saving capabilities and workflows: Use our portfolio reporting, financial planning tools, investment proposals, models/rebalancing, trading, contact management, document imaging, and workflows to satisfy the most discerning advisors, drive better client outcomes, and improve productivity.

- Unified Data Fabric®: Our proprietary data model that aggregates and enriches all types of data from hundreds of sources and consolidates it into a rich, unified format for delivering insights and providing advice.

- Configurable technology model: We use leading software development practices that allow for easy configurations while reducing the complexity of customizations—speeding up your time to market.

Innovate

Stay ahead of new demands with experts who continually innovate for your business

In today’s constantly changing world of wealth management, you need a partner with experts who understand your business, help you build trust with advisors, and continually innovate to help you grow. We combine our decades of wealth management industry experience along with our enterprise software expertise to deliver frequent, innovative solutions configured for your business—all while keeping your data secure and private.

- Deep industry and enterprise software experience: We bring decades of collective experience in wealth management, $1 billion invested in the platform, and expertise as a software provider.

- Our shared R&D model means you will always have the most up-to-date technology.

- Our forward-looking innovation lab and Investment Data Operations teams drive software development so you don’t have to.

- Enterprise-class services: We provide dedicated development, support, operations, and customer success services to each of our clients, marked by empathy and integrity, while remaining aligned to your success.

- Secure, private environment: We deliver a secure and private environment designed to earn the trust of our clients and help them build their businesses with confidence.

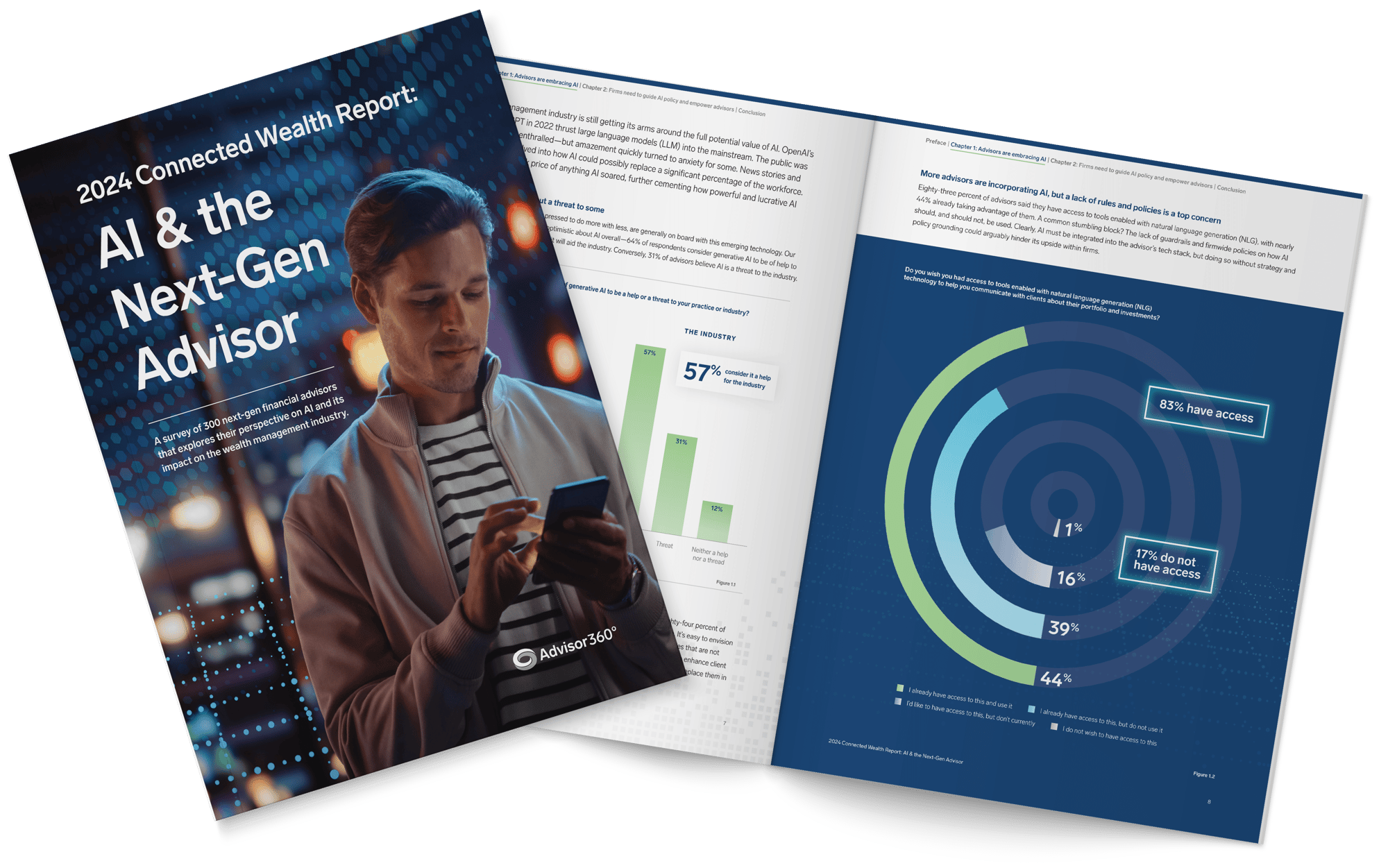

Gain additional insight with the AI Connected Wealth Report

As market and client demands continue to evolve, advisors cannot afford to fall behind due to outdated or inefficient technology. The AI Connected Wealth Report highlights these concerns and answers:

- What percentage of financial firms currently have an AI strategy?

- What area of your business would benefit most from AI.

- If generative AI is viewed to be a long-term help or a threat to the industry.